At first, I want to write something about the carbon emission policy in China, since the air pollution in Beijing was very serious recently. However, I was disappointed to find out that there is no complete carbon emission policy in China. The reason is pretty simple: Chinese government believes carbon taxes or permit will raise the production cost and slow down the economic development. As Chinese government put economic development at the first place, carbon tax or permit is off the table. Well, my question is, does carbon tax always have a negative impact on economics?

British Columbia is considered as the one of the first provinces or states in North America to implement a carbon tax. I visited the official website of BC Ministry of Finance and I was glad to find the carbon tax policy in BC is pretty attractive.

Policy Origin, Goals and Advantages

In November 2007, the Intergovernmental Panel on Climate Change issued a report showing that the Earth’s climate is changing because of human activities. It will become worse if no action is taken. So, on July 1, 2008, the BC carbon tax policy was implemented. The goal is to reduce greenhouse gas emissions (GHG) in BC. It’s estimated that B.C.’s carbon tax could reduce emissions in 2020 by up to three million tonnes of CO2 emissions annually, which is equal to taking almost 800,000 cars off the road each year. The tax on carbon emission is a critical component of B.C.’s Climate Action Plan to reduce greenhouse gas emissions by 33 per cent by 2020.

The government claimed that beside the advantage of reducing GHG, there are five advantages of the policy: (BC Ministry of Finance)

- This is a revenue-neutral carbon tax. That means, the BC government promises that every dollar collected from the carbon tax will return to taxpayers through tax reductions.

- The tax rate started low and increases gradually.

- Low-income individuals and families are protected.

- The tax has the broadest possible base.

- The tax will be integrated with other measures.

How the Policy Works

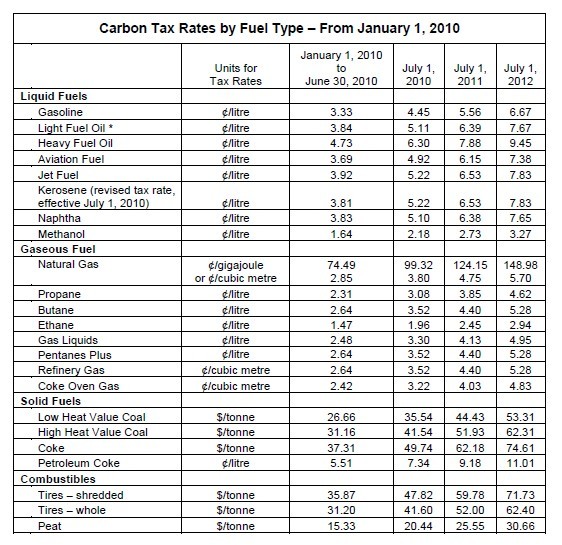

When the policy was first implemented, the tax rate stared low. It increased 5 dollars every year (from $10 per tonne of CO2 equivalent emissions in 2008 to $30 in 2012, no plan to increase anymore). I think this is really thoughtful since the factories need time to adjust themselves to emit less. The best part is that it is a revenue neutral carbon tax. Every dollar raised by the tax will be returned to both individuals and business through tax reductions. For example, in order to protect low-income individuals, a refundable Low Income Climate Action Tax Credit is designed to help offset the carbon tax paid by low-income individuals and families. I’ll discuss more about the revenue neutral carbon tax later. Since different fuels generate different amounts of GHG when burned, $30 per tonne of CO2 equivalent must be translated into tax rates for each specific type of fuel. The following table shows the per unit rates for selected fuels at July 1, 2012.

The Coverage of the Policy

The carbon tax applies to virtually all emissions from burning fuels, which accounts for an estimated 70 per cent of total emissions in British Columbia. Of the approximately 30 per cent of emissions that are not from fuels are not included in carbon tax:

- 10 per cent are from non-energy agricultural uses (e.g. emissions from enteric fermentation, manure management, and agricultural soils) and waste (landfills);

- 10 per cent are from fugitive emissions which cannot currently be accurately measured;

- 6 per cent are non-combustion industrial process emissions; and

- 5 per cent are from net deforestation.

The Province will look at options to extend the carbon tax to emissions beyond those generated by the purchase and use of fuels, and integrate the carbon tax with other climate action initiates such as cap-and-trade.

About the cost-effectiveness of the policy, I believe it’s pretty good. First of all, as the carbon tax was implemented, both the consumers and producers were hurt and deadweight lost was formed. However, as the government returned the money collected to the tax payer, the deadweight lost decreased. I was surprised to find out that the government even paid more than it collected. The average consumption of fuel per person in British Columbia decreased 4.5%. It’s a pretty successful policy. So, the carbon emission control policy is good and deadweight cost has been decreased as much as it can. I think it is a pretty good policy.

Distributional Effectiveness of the Policy

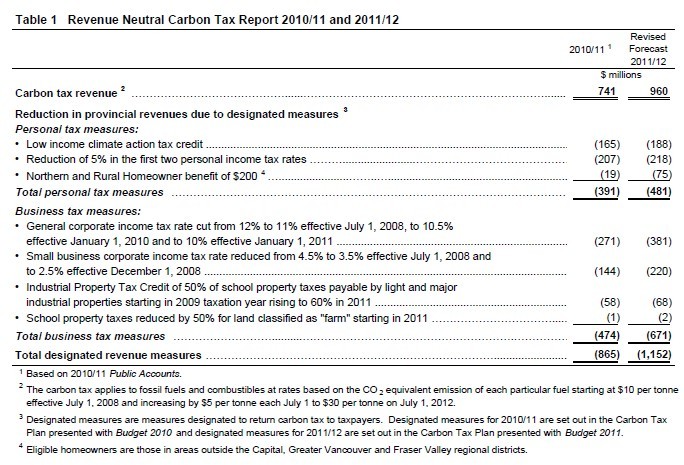

As the government returns the carbon tax to British Columbians, how will the policy affect people? As we can see from the table below, in 2010, the government collected 741 million dollars from individuals and business and returned 865 million dollars to people through tax reduction! The BC government is investing money to the policy.

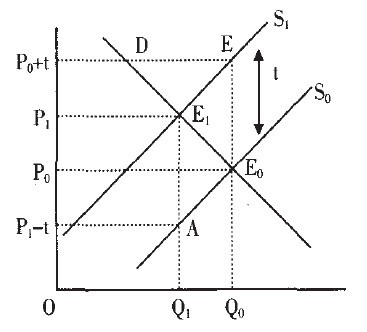

Now, let’s look at how the policy will affect individuals and business. As we can see from the table below, before the carbon tax, the production quantity is Q0 and price is P0. After the carbon tax(t dollars), the price increases to P1 and the quantity decreases to Q1. Now, consumers need to pay P1, so they are losing money. The producer, however, can receive P1, but after the tax, they can only get P1-t, less than P0. So, both of producer and consumer are losing money after the carbon tax.

However, as the government return the tax (even more than tax revenue), both individuals and business can get some benefit. So, is it true that British Columbians don’t lose benefit? Well, for individuals, the tax return is mostly beneficial to low-income individuals and North and Rural Homeowners. The policy is less friendly to middle class British Columbians although there is a reduction of 5% in the first two personal income tax rate policy. For business, although the carbon tax can return the carbon tax as tax return to the companies, the government can’t return the loss of the sales. That means, the policy is still hurting the business.

Conclusion

So, in total, the carbon tax policy in BC can hurt business and middle class consumers but it is friendly to environment, low-income individuals and North and Rural Homeowners. I do think it is a successful policy since it tries it best to reduce the deadweight loss and improve the environment at the same time.

Hi Peter, thanks for sharing the information. Your blog entry is very concise. You’ve mentioned that the carbon tax policy hurts businesses. Does the government offer any kind of subsidy or financial support to help carbon reduction?

The point of sales incentives for Clean Energ Vehicle Program (CEVs) was first introduced in 2011. Do you think $500 Clean Energy Vehicle Rebate is an attractive offer to encourage BC owners of a MURB (Multi-unit residential buildings) to invest?

Thanks for your reply Vicki! I don’t think the 500 bucks rebate policy is attractive enough. As we know, the cost of owning a clean energy car is much higher than a regular car. People don’t have incentive to buy clean energy cars~

Good job! anyone focus on the BC policy. I think the clean energy vehicle rebate is an attractive offer to encourage BC owners to invest.

Thanks Zoe! Clean energy still has a long way to go. Some vihicle campanies invest a lot on battery power cars (for example, BYD, it was a world class battery company in China) and hybrid cars because they want to capture the market before any other companies.