Whether it be the retail industry or tech sector, it seems as though many companies these days are stocking up on assets. Softbank in Japan is no exception, as their recent acquisition history paints a vivid picture of the competitive business market . Their recent attempt to buy T-Mobile might have failed but they have now set their eyes onto DreamWorks Animated in a deal rumoured to be worth $3.4 Billion. To provide some context, Softbank is a communications and media company that is looking to diversify it’s portfolio and move into new content.

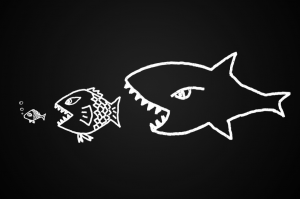

In the big picture, technological companies have been taking over an increased number of other corporations over recent years. Big players such as Google and Amazon are making new acquisitions and offshore competitors such as Softbank, and probably Alibaba in the near future, are doing the same. It’s an arms race to find growing assets that can add value to the company taking them over. In the case of Softbank, they had $17 billion in cash at the end of June (as mentioned in the article), and decided they wanted to splurge. Can you blame them? If the cash stays stagnant it isn’t making you more money, so why not put it into an acquisition where some fine tweaking of the company to be taken over can provide increased revenue and value to the parent company. It’s a trend that large companies will continue to follow to gain a competitive edge over the rest of the industry.