Comparison of Data Classification Methods

Depending on which quantitative data classification you use, it could produce drastically different results. This is demonstrated in the Cost of Housing in Vancouver Using Four Data Classification Methods. For instance, if I were a journalist I would most likely choose the Standard deviation data classification method to show my audience. This is because the data is skewed to the right and does not show a normal histogram/distribution. As such, it would indicate to my reader that the average cost of housing is much greater than the median cost of housing in Vancouver. Plus, given that the high housing costs in Vancouver are still rising it would make sense to use standard deviation to show that trend. However, one of the disadvantages of using this method is depending on the general reader’s education level and familiarity with statistics, the Standard Deviation method may be confusing to some readers.

Again, if the purpose is completely different I would certainly have to reconsider which type of data classification I would use achieve the best results. Compare being a journalist to, let’s say, a real estate agent. If I were a real estate agent I would pick the Natural Breaks classification method instead. This decision is driven by the reason that it is relatively easier for prospective home buyers to process and understand statistically than Standard Deviation. Visually, it effectively gives the buyer a better sense of the uneven distribution of housing costs across Vancouver, no matter how subtle that difference may be to begin with. In other words, it would give the impression that the buyer has more options to explore. This could potentially translate to a higher chance of a successful deal for the agent, particularly if the buyer is feeling optimistic, is willing to invest a considerable amount of time and money, and is lucky enough to find their perfect match. A win-win situation for both the real estate agent and the home buyer.

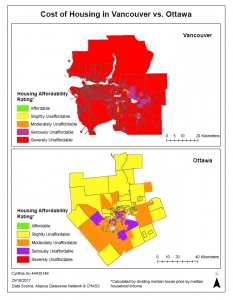

Comparison of Housing Affordability in Vancouver and Ottawa

Essentially, Affordability measures the relationship between median household income and income needed to purchase a median-priced house. In comparison to housing cost, housing affordability is a better indicator because displaying housing cost alone will not convey important information about whether or not individuals or families have the financial capability (i.e. income) to purchase a residential property for personal use.

The housing affordability rating categories used to create this map was determined by the 12th Annual Demographia International Housing Affordability Survey 2016 (Wendell Cox Consultancy & Performance Urban Planning: Christchurch, New Zealand), a reliable report that borrows findings from countless other surveys and studies to help tackle the housing affordability problem all around the world. The housing affordability rating classification ranges from a Median Multiple of 3.0 or less being ‘affordable’ to over 5.0 being ‘severely unaffordable.’

While housing affordability is definitely a good indicator of a city’s level of livability, it is not the only factor that matters. Other components of living needs to be taken into consideration as well, including job markets, safety, entertainment, transportation, pollution etc. If you solely focus on housing affordability, it becomes very easy to assess a city by its survivability rather than its livability. Furthermore, it is important to keep in mind that the housing affordability rating categories has its limitations. To quote Oliver Hartwich, the Executive Director of the New Zealand Initiative, he comments: “The ‘median multiple’ is not a perfect measure because it does not account for house sizes or build quality.” As such, a city’s level of livability also depends on the type of residential housing that people can afford to live in, such as houses, apartments, condominiums, lane housing etc.