Lesson 1.3 Definitions and Peer Review

Objective: The objective of this exercise is to define a relatively complex term in three ways: a parenthetical definition, a sentence definition, and an expanded definition. The definitions should vary in detail depending on the audience. This exercise is to practice explaining a complex term to an audience with little to no technical background on the subject.

Term:

Absorption rate

Situation and audience:

Real estate analysts use this term to explain to developers, real estate salesperson or investors how fast houses are selling in the current market environment.

Parenthetical definition:

Measures how fast available homes or newly built houses can be sold after completion.

Sentenced definition:

The absorption rate can be used to estimate the rate at which houses in a particular market are sold over a specific time frame. The rate can be expressed in units, months, or percentages.

Expanded Definition:

In the real estate market, the absorption rate will provide investors insight into how quickly or slowly houses are selling. A high absorption rate indicates that the supply of houses will run out quickly as the inventory (newly built houses) will deplete rapidly. This shows that sellers can demand more money for their property as more buyers are seeking to buy from a limited source of inventory. On the other hand, a low absorption rate indicates the opposite where sellers are seeking to sell to a limited pool of buyers. Vancouver has an absorption rate of 80%, this is considered very high (Avison Young, 2019).

Example showing how to calculate the absorption rate:

If a city has 1,000 homes currently listed on the market to be sold and buyers purchase 100 homes per month, the absorption rate is 10% (100 sold homes divided by 1000 available for sale).

Source: https://corporatefinanceinstitute.com/

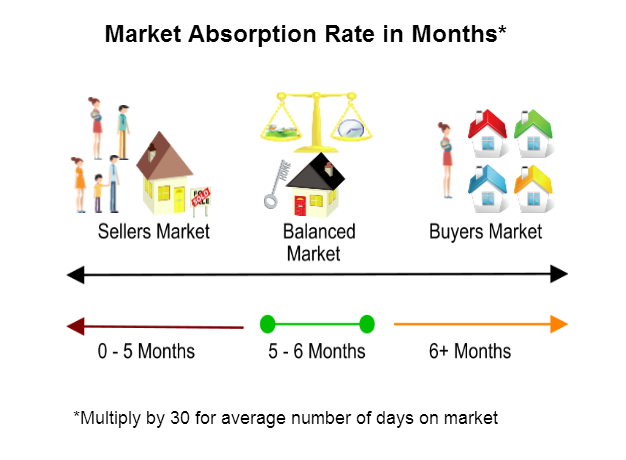

The absorption rate can also be converted into a time period to estimate how long will it takes to sell the current inventory. Using the previous example, there are approximately 1000 newly built homes in an area and buyers are purchasing 100 homes per month, it will take approximately 1000/100= 10 months for all the listed properties to be sold. According to Remax, a leading residential and commercial real estate sales firm, six months or more is considered a buyers market where buyers have more bargaining power. In Vancouver, it has been a seller’s market for most of the time.

Source: https://www.remaxreinvented.com/sellers/how-can-we-help/what-are-absorption-rates/

In conclusion, the absorption rate gives real estate market participants an idea about how much activity has happened in a specific area and time frame. It does not tell what the future market behaviour is going to be like but land developers and investors still use this as one of the many tools they have to estimate future price movements.

Work cited:

Avison Young (2019). 2019 Year0End Market Report. Retrieved October 26th, 2020, from https://www.avisonyoung.ca/documents/95750/1691318/Avison+Young+Office+Market+Report_2017+Year+End.pdf

Somer G. Anderson (2020). Absorption Rate. Retrieved October 26th, 2020, from https://www.investopedia.com/terms/a/absorption-rate.asp

Leave a Reply