This paper is based on the Department of Fisheries and Oceans Integrated Management Plan for Pacific Sardines, revised in 2013. Unless otherwise cited, specific references to fishery management, quotas, etc. are from this primary source.

An Overview of The BC Pacific Sardine Fishery

Although not nearly as well-known as the salmon or halibut fisheries, BC’s Pacific sardine fishery has a long and tumultuous history in this Province. The commercial fishery was established during World War One and in its heyday averaged catches of 40,000-80,000 tonnes per year[1]. The 1940s brought an abrupt end to the Pacific sardine fishery, a demise that has been attributed to overfishing and unfavourable environmental conditions.[2]

The BC Pacific sardine fishery took 45 years to recover, and it wasn’t until 1992 that sardines were again observed off B.C.’s coast. In 1995 the government deemed the stocks to have recovered sufficiently to set up a small experimental fishery[3] which was formalized in 2007 in an Integrated Management Plan under the Department of Fisheries and Oceans (DFO).

Migration and Coverage

The DFO characterized the Pacific sardine fishery as an “opportunistic fishery dependent on the migration of sardines into Canadian waters”[4]. Sardines arrive in BC in early Summer and it has been noted that the presence of sardines in BC is a function of their overall abundance on the entire Pacific Coast[5]. The fishery catch quota is established by observing stock data from the California fishery and applying a ‘migration rate’ calculation of about 10%.

The BC sardine fishery operates primarily off the Coast of Vancouver Island and is a multi-species fishery, with mackerel and salmon as the main by-catch. The fishery is open from June 1st to February 9th each year with the exception of permanent and seasonal closures.

License Allocation

Annual total allowable catch is evenly divided among 50 individual vessel based licensees (meaning the quota allocation is tied to the vessel not to an individual). 25 of these licenses are awarded to a standard commercial fleets while the other 25 are awarded to commercial First Nations fleets (also known as communal commercial). First Nations are also able to fish for food, ceremonial and social purposes although the DFO reports that no sardine fishing took place under FCS in 2010. Recreational fisherman can also participate in the fishery by obtaining a BC Tidal Waters Sport Fishing License. The DFO does not track the level of effort or catch of this group.

Initial license allotment can be difficult in a new fishery, and in response to fisherman’s desires for a stable and certain license environment, the DFO engaged in a consultative process in 2007 to establish permanent license eligibility based on three criteria: number of years licensed, landings and effort. This process concluded in 2009, with 25 permanent licenses issued to the commercial fleet which guaranteed each vessel an individual quota and henceforth a percentage of the TAC. In 2007, the DFO also undertook a pilot program to test the effectiveness of allowing quota transfers between vessels and allowed a maximum of 5 unfished sardine licenses to be issued to one vessel at a time, a process known as ‘stacking’. Since the quota is vessel based, this is an all or nothing proposition, as a fisherman cannot transfer a fraction of quota, only the whole quota.

Efficiency and Monitoring

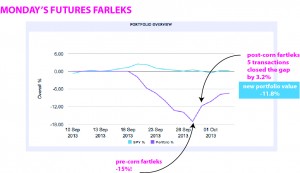

Stacking has arguably led to commercial efficiency in the sardine fishery. Based on the table below landings from 2002 to 2009 were well below TAC, while these numbers merged in recent years with the introduction of quota transfers. This would suggest that past levels of effort did not result in an economically efficient industry catch and that the transfer of quota has been beneficial in reducing the impact of ‘too many boats catching too few fish’. The DFO reports that in 2009, ½ of the vessels had 3 or more licenses and that 5 vessels accounted for ½ of the licenses (p.17).

Since landings have never reached TAC, the efficiency of the policy can be viewed in terms of reducing overcapitalization of the fleet and reducing imbalances that could lead to unreported exploitation of the species. In this case, fisherman have been incentivized to change behavior to catch more fish and become more efficient, but since landings were below TAC, this is seen as positive development. Vessels exceeding their individual catch quota (or stacked quota) would be the primary concern for enforcement, but the DFO allows a vessel with remaining quota to remove sardines from the purse-seine of another vessel if said vessel is over quota so long as both vessels follow proper log procedures.

In addition to 100% at-sea-observer regulations from 2009-2011, each vessel must land all catch at its designated port. A vessel may only process its own catch and may only offload on land when a official validator is present at which point the validator will weigh and inspect the catch and mark it off against the vessels outstanding quota.

By-catch

Purse-seine gear is the only allowed gear and is somewhat selective as it used to encircle and trap schooling fish. Unless other species are schooling with the target species, by-catch will be limited. Chub and Jack Mackarel are the main by-catch and each vessel is permitted to harvest a combined 10 metric tonnes of these species. This allowance is designed to be large enough to prevent by-catch dumping, while being small enough to prevent the development of an offshoot mackerel fishery. So long as the allowed tonnage for by-catch falls within an achievable range, this is a good measure to combat dumping.

Migrating salmon are of special concern since their migratory paths overlap the sardine fishery and the salmon could become unintentional (or intentional) by-catch. “From 2008-2011, 100% at-sea observer coverage was utilized in the sardine fishery to monitor the impacts of the sardine fleet on salmon stocks.”(p.20). The fishery was determined to be compliant with all quota requirements and by-catch mitigation measures and the DFO has relaxed its 100% at-sea-observer mandate to a minimum of 25% with additional enforcement during peak salmon migration periods. The sardine fishery has a Salmon By-Catch and Discard Management Program that outlines specific monitoring requirements and fishery closures zones, the preferred method for limiting salmon by-catch.

Although the industry has enjoyed success over the last few years, in 2013 the purse-seine commercial fleet came up empty handed, having not landed a single fishin the former $32 million dollar industry.[6] Sardine stocks are known to be characterized by a boom and bust cycle, so this is not entirely unusual and can be mostly attributed to changes in the ocean environment. The disappearance of the sardines however has also marked the disappearance of the humpback whales that feed on them, as well as the tourists that come flocking to whale watch and serves to remind us us how interconnected we are.

List of Works Cited

[1] Pynn, Larry (2013) BC’s Sardine Fishery Collapse – Affecting the Economy, Ecology along the entire Food Chain. Postmedia News. October 15, 2013. Available online at http://news.nationalpost.com/2013/10/15/b-c-sardine-fishery-collapse-leaves-a-hole-in-the-marketplace-repercussions-up-the-food-chain-to-humpback-whales/

[2] A History of British Columbia Seafood (2008). BC Ministry of Environment: Oceans and Marine Fisheries .Victoria, B.C. Available online at http://www.env.gov.bc.ca/omfd/reports/seafood-poster.pdf

[3] A History of British Columbia Seafood (2008)

[4] Pacific Region Integrated Fisheries Management Plan (2013) Department of Fisheries and Oceans. Available online at http://www.pac.dfo-mpo.gc.ca/fm-gp/mplans/2013/sardine-2012-15-eng.pdf

[5] The Sardine Industry: Sustainability and Development (Draft Discussion Paper) (2009) Canadian Pacific Sardine Association. Available online at http://www.bcsardine.ca/wp-content/uploads/2013/05/cpsa_discussion_paper_sust_devt.pdf

[6] Pynn, Larry (2013)