Hi there!

It’s week 2 of the futures trading game! Gain a bit, Lost a lot!

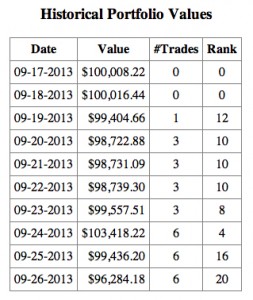

Here’s a peek on what I have on my portfolio by today to give you a picture on how bad it is (figure 1):

This is my Portfolio Summary of the ending of week 2, as you can see, I’m bleeding! However, week 2 wasn’t that bad, I was given a taste of victory when my portfolio went back to green that puts me up in top 5 ranks and gaining some money (Figure 2 and 3). But, just like a roller coaster ride, I didn’t stay up long in that position. In fact, my portfolio crashed down. I do have some lessons learnt over this ride to share, so here goes!

Figure 2. Historical Portfolio Value

Figure 2. Historical Portfolio Value

Lesson 1. “Listen to your instinct”

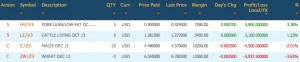

Believe it or not, sometimes gut feeling works wonder. At the end of week 1 or beginning week 2, I have this random thoughts that suddenly popped up and bugged me. It’s about the month of festivity that’s coming, which is December. As you all know, December is the month where people spend most of their annual salary on christmas presents and annual get away. It is identical with long holidays to have some family quality time. So, i thought, festivities mean food and by food I mean lots of them. This leads me to buy the futures of living cattle and lean hogs as I predict that demand of meat will go up. Turns out I was right, even though the price went up mostly not because of that. But hey, gut feeling is proven to be worth listening to! Figure 4 and 5 show the market trend of lean hog and live cattle respectively from CME group website

Figure 4. Lean hog market trend

Figure 4. Lean hog market trend

Figure 5. Live Cattle market trend

Figure 5. Live Cattle market trend

Lesson 2. Market always goes to wherever it wants to go.

Since I have no good insight of the futures market, I decided to look for an expert predictions and came across Philip Shaw’s market commentary on Grain Farmers of Ontario web page. He predicted that corn price will not waver and revolve around current number and that wheat is trending down. Of course I didn’t go on short right away after reading this. I followed the market price for two days and seems like he was right. So I went short on both commodities and the next thing I know both price shot right up! There goes my green portfolio.

Lesson 3. Fundamentals approach is like playing roulette.

Information is the game changer in trading game. Having the timely delivered and precise information will change everything. In this simulation game, however, I have a very limited source even though they are reliable, for example, the no tapering issue. The market price went so high after the news was heard but then it plummeted after the prediction that tapering will still go on. This makes news as guidelines on what to buy and not to buy will always be “one step behind”.

Lesson 4. Delay, Delay, Delay

Stocktrack is seriously giving me a hard time! Delay in transaction means I lost one of the most important factor in trading, which is TIME! nothing I can do about this, so I’ll have to coupe with it, somehow.

Things to do for week 3!

1. Even though I have no idea of what’s going on right now in the market, as price volatility is so high, losing in trading only have two options, be firm on your ground or exit right away and start fresh. For week 3, I’ll stay on my ground in hope that the market will actually go back to its predicted trajectory.

2. Try to learn Technical stuff to predict the market in order to survive longer. And yes, by technical I mean numbers and stats! Fingers crossed 🙂

References

Some cool and helpful websites for you guys to check out news of the market::

– Futures

– Top 100 Futures Blog (It’s a bit outdated, but it’s better than nothing)

Have a great weekend fellas and wish you guys plenty of luck!

Cheers =)

One reply on “A Roller Coaster Ride”

Hi Bee,

Your intuition on price movements based on seasonality in consumption is actually very well-founded. Many commodities, stocks, and other tradeables do exhibit such seasonality in their prices. If one were very disciplined, it is actually possible to consistently make money by trading around seasonality. What you want to do when looking for seasonality is to look at price data going back further, over the past 10 years, for example.