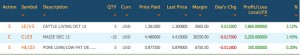

Finally, after 5 weeks long my portfolio shows an all green from all my open positions *cheers*!

Here’s what happened this week:

1. 7-month high living cattle

Speculators went long on living cattle futures expecting that there will be a tighter supply of cattle in the upcoming months. Seems like I share similar thoughts with them. Based on the lesson that we got, should we start to consider going short on living cattle? It is said that as more speculators go long on future contracts, it will bid the price down (Econ 101). But wait, hold that thought! Reuters reported that thousands of cattle were lost to the freak blizzard in South Dakota a week ago. This further squeezes the supply for living cattle. Short supply means price will stay high for the time being (another econ 101). So, should we go long or go short on living cattle contracts? I’ll leave that part to you to decide 😉

2. Lean hog price settlement

My Oct’13 Lean hog contract expired on 15 Oct and I gained a bit from that and decided to buy the March ’14 contracts as I believe that the livestock market still shows a promising return (December is coming remember?). There is one thing that’s interesting on this Oct’13 contract expiry though. As we all know, US government has just ended its shutdown yesterday (Oct 17). So, with no cash market data supplied by USDA when the contract expired, how was the final price settled?

When contract expired, the futures price should be the same with the current cash price. However, with no data supplied by USDA due to the government shut down on the contract maturity date, this goes under the category of “force of nature”. The rule book of trading decided that if there is a force of major (like this), the price settlement will be based on the weighted average of the previous trading price, which in this case is Oct 11 and Oct 14. This opens up a lot of chances of price manipulation. However, CME group said that they will step up to do a surveillance of the pricing formula in order to prevent price manipulation from happening.

3. Soybean is bullish

As corn and wheat prices fell, soybean rose high as speculators expected a lower supply due to slow harvest in the central area of the US, the biggest producer of soybean. Jeff Wilson from Bloomberg reported that Southern Nebraska and central Alaska were at risk of frost or freezing weather. Rains also delay the harvest as it prevents farmers from going to the field, but, Tim Emslie, a research manager in Minnesota, promised that farmers will get back to the field later this week so that the rally may be limited. Since traders don’t know what is actually happening to the crop as USDA hasn’t released any crop condition report due to the partial government shut down, they can only predict that there will be limited supply. For those trading soybean, you better watch out when USDA releases the crop condition report. It may go with your prediction but it may also go the other way.

After US government ended its partial shutdown and USDA gets back to work on Thursday, these last couple of weeks of October will be a dreadful one for speculators. Earlier this month when the government decided to shutdown causing a limited data supplied by USDA, one of the biggest producers of grains, traders were afraid of the day they start to operate again. Lack of data might have given them a hard time for the last couple of weeks, but the questions are, when the data is available again, will it support the speculations or not? If it shows different numbers, how big is the difference between the actual data and the speculation?

Before I wrap up my weekly post, here is a good “food for thought” to think about

“Why is the man/woman who invests all your money is called a broker?”

Leave me a comment if you know why since I’m pretty curious on the answer as well =)

Have a great sunny weekend peeps!

Cheers