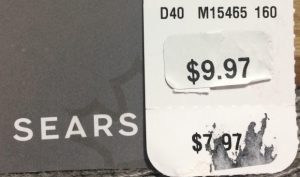

As the news around big liquidation sale of Sears has surged on various websites, a potentially unethical business behavior is unveiled: customers found original priced tags have been replaced with a sticker stating higher price. From the picture below shows the ripped new price tag and the original price at $2 lower.

Price Tags(Biggin. V, 2017)

Price Tags(Biggin. V, 2017)

Through the economic lens, it can be easily explained that Sears adjusts their price due to the increase in demand. However, since the demand is created by the incentive of discounts, in other words, the promised reduction in price, re-adjusting the price of items becomes an arguably unethical action for consumer perception since the real benefit to consumers are now lesser than expected from the promotion. Therefore, some consumers see such action as a betray in trust from the retailer.

After this behavior is revealed and disclosed through media, the demand of the items will likely to decrease significantly due to the decrease in incentives from the promotion. Although other retailers may overcome the negative public image they receive from such news articles, Sears may end-up with a permanent wound, because the nature of a liquidation sale. Once customers of Sears discover such behavior and demand for sales items decline dramatically, a recover in demand usually takes longer period of time or needs higher incentive to purchase the items, giving Sears to possible paths: extend the sale period longer or increase sales percentage to reduce price furthermore. By extending the sale period longer, Sears will automatically increase the operation costs due to the requirement of labor and utilities, which results in reduced profit. Moreover, there is no guarantee that the demand of customers will last and recover after the ramp-up time. On the other hand, if Sears chooses to lower the sale percentage, although the incentives is likely to increase demand back up again, consumers may question that similar incident will occur again: even the sales is announced at higher percentage reduction, the original price may have been altered again. In short, either option will leave Sears a reduction in revenue comparing to the current promotion model.

In conclusion, the business act of Sears leaves its customers a gap of trust, which does not only costs Sears to sacrifice additional profit from the liquidation sale. Thus, despite whether the action is economically natural, it is for the consumers’ perception and decision on the boundary of business ethics, that ultimately affects the reputation and profitability of the firm in the end.

Word Count: 439

Biggin, V. (2017, October 29). [Price Tags]. Retrieved October 29, 2017, from http://www.cbc.ca/news/business/sears-canada-liquidation-sale-higher-prices-1.4373270

Harris, S. (2017, October 29). ‘Duped’: Sears shoppers allege retailer inflated prices for liquidation sales. Retrieved October 29, 2017, from http://www.cbc.ca/news/business/sears-canada-liquidation-sale-higher-prices-1.4373270

Nasdaq, n.d.

Nasdaq, n.d. Ransbotham, S., April 2016

Ransbotham, S., April 2016