The recent collapse in oil prices has led to a severe depreciation of the Canadian dollar and has sent world markets reeling. Canada’s dollar is heavily tied to resource prices, and as a petro-dollar, expected future oil prices have a large effect on the stock market, exchange markets, as well as future industry projects.

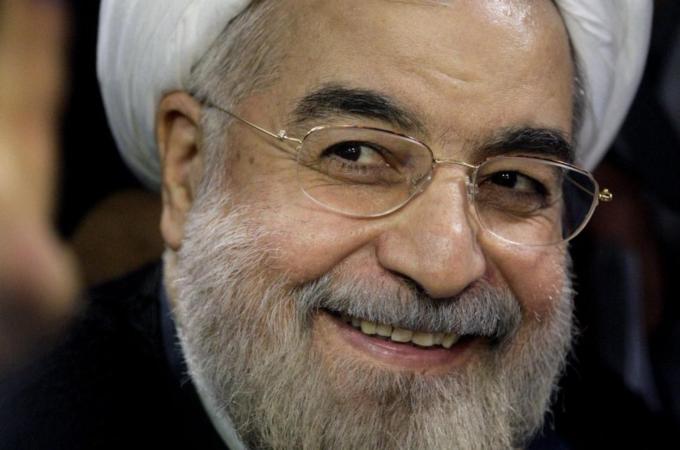

Prime Minister Hassan Rouhani, a moderate, will likely support a deal to return Iranian oil to world markets.

This article from Thestar presents compelling analysis and speculation on oil prices for the future. However, based on my analysis, this article understates several important factors. Firstly, the article claims that “Iranian oil has been largely held off the market due to sanctions[….]If negotiations can resolve that issue, production from the world’s second-largest holder of conventional oil will flood an already glutted market.” This analysis understates the urgency of a nuclear deal in the eyes of Tehran. In fact, it’s quite likely that Rouhani will bow to internal pressures within Iran, which is facing a 19.4% inflation rate and 16.4% unemployment.

This pressure is underscored by this Haaretz article which outlines the possibility of a deal by November 24th. A supply shock such as the reemergence of Iran on the world markets would negatively impact the Canadian oil industry, and would certainly cause further depreciation of the Canadian dollar, as well as losses within the TSX, which is heavily reliant upon resource prices.

Sources Used

http://www.haaretz.com/news/middle-east/1.625316

http://www.thestar.com/business/2014/11/07/collapse_in_oil_prices_should_come_as_no_surprise.html

http://en.wikipedia.org/wiki/Economy_of_Iran

http://www.aljazeera.com/mritems/Images/2013/6/11//2013611165820528734_20.jpg