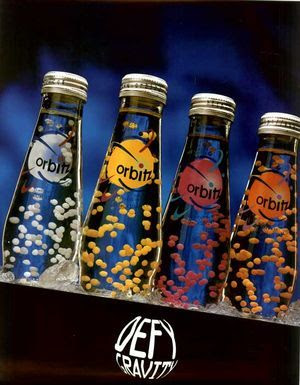

Orbitz was the brand name of a fruit-flavored beverage that was originally created by “Clearly Canadian.” These unique beverages resembled lava lamps where the edible balls were able to float or “defy gravity” because they had a similar density to the surrounding liquid. Although the beverage was unique, poor sales caused this company to go out of business. This reminds me of the importance of brand positioning which was recently discussed in class. Brand positioning focuses on getting into the consumer’s mind first as it has been stated that it is easier to remember who is first but much more difficult to remember who is second. Orbitz came up with this creative new idea that consumers had never seen before; however, they were unsuccessful because they were up against dominant established brands such as Coca-Cola. At the time and up till now, Coca-Cola has always maintained strong advertising abilities as they spend millions of dollars each year trying to get their brand out to the public. Orbitz was unsuccessful in that they could not compete against a global market leader such as Coca-Cola which has been around since 1955. In order to stand the test of time, startup companies need to emphasize the importance of brand positioning by perhaps using celebrity endorsements or other forms of creative advertising to ensure its longevity.

Here are some past Orbitz Commercials!