London Congestion Pricing System

A good method to solve the urban traffic problem

Background

Traffic congestion in central London is a historical problem for this old city. In 1995, the London Congestion Research Program inferred that with a congestion pricing system, the city’s economy would benefit a lot. And later in 2000, Ken Livingstone first formally presented the system to the public in his London Mayoral Election manifesto. In order to reduce congestion and to increase investment funds for London’s transport system, the Congestion Pricing system was introduced on 17 February 2003.

Policy Principle

- Coverage and exemption

According to this charge system, most motor vehicles driving within the Congestion Charge Zone (CCZ) in central London between 07:00 and 18:00 Monday to Friday need to pay the congestion fee. Weekends, public holidays or between Christmas Day and New Year’s Day (inclusive) are exemptions. The charge area includes one of the world’s largest congestion charge zones and the Western Extension (operated between February 2007 and January 2011). The charge operates for under one third of the hours in a year and covers around two thirds of the central London traffic.[1] Registered cars which emit 100g/km or less of carbon dioxide and meet the Euro 5 standard, vehicles with 9 or more seats, motor-tricycles, accredited breakdown companies and roadside recovery vehicles receive 100% discounts.[2]

- Current Charging Standard

The standard fee for applicable vehicles is £10 per day if paid by midnight on the day of travel, £12 if paid by the end of the following day, or £9 if registered with CC Autopay.Businesses with ten or more vehicles can register with Transport for London (TfL), and will be charged £9 per vehicle per day for each vehicle detected within the zone.[3] Failure to pay results in a fine of £120, reduced to £60 if paid within 14 days, but increased to £187 if unpaid after 28 days.[4]

- Refunds and The Use of Surplus

Refunds are available to people who pay monthly or annual in advance whose plans change; reimbursements are available to NHS patients assessed to be too ill to travel by public transport, NHS staff using vehicles on official business and fire fighters.[5] By law, all revenue must be reinvested into London’s transport infrastructure.

Effects

- Traffic change

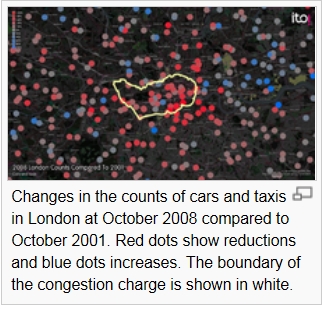

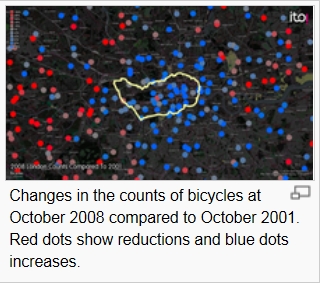

1) Traffic volume: In 2007, TfL found that “the number of chargeable vehicles entering the zone had reduced by 30%, while there were overall increases in the numbers of taxis, buses, and especially bicycles.” However, traffic congestion during the morning peak had not reduced.

* Transferred from en.wikipedia

2) Traffic speed

Without the policy, TfL estimated the speeds would have dropped from 17 km/h in 2003 to 11.5 km/h by 2006. A report by TfL in early 2007 indicated that there were 2.27 traffic delays/km in the original charging zone while before the number is 2.3.

- Air quality

In 2011, Health Effects Institute (HEI) found that there is little evidence the congestion pricing system has contributed to the air quality.

| Charging zone | Inner Ring Road | |||||

| NOX | PM10 | CO2 | NOX | PM10 | CO2 | |

| Overall traffic emissions change 2003 versus 2002 | −13.4 | −15.5 | −16.4 | −6.9 | −6.8 | −5.4 |

| Overall traffic emissions change 2004 versus 2003 | −5.2 | −6.9 | −0.9 | −5.6 | −6.3 | −0.8 |

| Changes due to improved vehicle technology | −17.3 | −23.8 | −3.4 | −17.5 | −20.9 | −2.4 |

|

* Source: Transport for London 2003–2004 figures are TfL estimates. |

||||||

- Parking Issues: In order to avoid the congestion fee, many citizens choose to park their cars in outer London district, which causes new on-street parking issue.

Policy Evaluation and Conclusion

- Benefits and Cost Analysis

Initially, Tfl expected that the surplus of this system would be around £200 million. According to a report issued in February 2007, “the initial costs of setting up the scheme were £161.7 million, with an annual operating cost of about £115m anticipated. Total revenues over the first three and a half years had been £677.4 million, with TfL reporting a surplus over operating costs of £189.7 million.” What’s more, the Bow Group claimed that by 2007 the policy had only returned an approximate £10 million profit.

The initial operating revenues from the scheme did not meet the levels that were originally expected. Within six months from the beginning of the policy, the reduction in traffic had been such that TfL were anticipating a £65 million revenue shortfall.

|

Revenues (£m) provisional |

2004/5 |

2005 |

2006/7 |

| Standard daily vehicle charges (currently £10) | 98 | 121 | 125 |

| Enforcement income | 72 | 65 | 55 |

| Fleet vehicle daily charges (currently £7) | 17 | 19 | 27 |

| Resident vehicles (currently £4 per week) | 2 | 2 | 6 |

| Other income | 2 | ||

| Total revenues | 190 | 210 | 213 |

| Total operation and administration costs | (92) | (88) | (90) |

| Net revenues | 97 | 122 | 123 |

|

Expenditure (% of operating revenue) |

2004/5 |

2006/7 |

| Bus network improvements (incl. vehicles, garages & shelters) | 80% | 82% |

| Road and bridge maintenance & upgrades | 11% | |

| Road safety (incl. research & campaigns) | 11% | 4% |

| Walking & cycling programmes & publicity | 6% | 2.5% |

| Distribution and freight (incl. review of a London lorry ban) | 1% | |

| “Safer routes to schools” initiative | 2% |

*Source: Impacts Monitoring – Third Annual Report” (PDF). Transport for London. April 2005.

- Conclusion

In general, this congestion pricing system is fairly effective. It achieved its original goal to some extension. This policy truly reduced the total urban traffic volumes and increased the traffic speed.

However, this system is still immature. On one hand, during the morning peak time the congestion issue still exists. On the other hand, economically speaking, according to the revenue report we can see clearly the initial operating revenues from the congestion charge did not meet the levels that were originally anticipated, which means the policy is costly. What’s more, the scheme is not flexible to the change in weather or emergency, so that it’s unfair to the taxpayers.

Therefore, in order to solve this fault, I suggest the Tfl should introduce a more complex system which charges drivers according to the congestion degree of the road rather than the uniform time and districts. And of course, they also consider more how to reduce the operating cost to get their maximum profits.

Reference

[1] Impacts Monitoring – Fifth Annual Report. Transport for London. June 2007.

[2] Discounts and exemptions. Transport for London. 13 April 2012.

[3] When to pay. Transport for London.

[4] Penalties and Enforcement. CCLondon.com. Transport for London.

[5] Transport for London Refunds and reimbursements. Transport for London. 13 April 2012.

[6] Wikipedia, http://en.wikipedia.org/wiki/London_congestion_charge#Parking_issues_in_outer_London