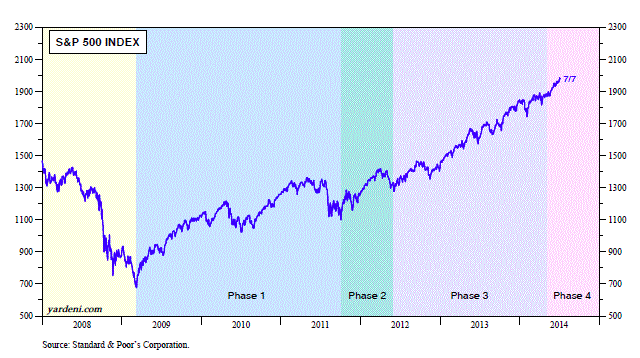

Dr. Ed’s blog- The Four Phases of the Bull Market indicates and explains four different stages of a Bull Market, which is “a financial market of a group of securities in which prices are rising or are expected to rise”(^1). As the diagram above shows, the bull market starts from the early 2009, and we are now encountering the 4th Phase, which is described as euphoria by Sir John Templeton, a British stock investor.

I find this blog useful because Dr. Ed analysis the bull market’s S&P 500 Index for the past several years and make expectation for the future market. For investors, they could make determinations about whether to invest in the market or not by checking the developing trend of the market. Apart from that, although the general trend of a bull market is generally increasing through years, we can see from the diagram, there has slightly downward slopes between each phase. Analysing which period a business current in can helps investors to decide the right timing for investments in order to make better feed back.

I also find this blog interesting because Dr. Ed uses both Sir John Templeton and Laszlo Birinyi, two professionals’ descriptions of bull market’s four phases, which makes audiences have better understanding about the characteristics.

Dr. Ed Yardeni’s blog link: http://blog.yardeni.com/2014/07/the-four-phases-of-bull-market-excerpt.html

Reference: ^1 www.investopedia.com/terms/b/bullmarket.asp