The federal government shutdown, leaving traders and food producers in the dark

In this week’s blog, the first thing that I want to share with you is the big news: the federal government shutdown. In many ways it could affect the whole world, but the most significant influence on us could be showed clearly via this picture:

As the shutdown of the U.S. government enters its third day, it seems that we are going to miss the October crop report. The monthly crop estimates released by USDA often cause swings worth billions of dollars in the price of corn, soybeans, wheat and cotton. It is reported that U.S. livestock markets are reeling from this week’s disruption of data from the U.S. Department of Agriculture as the federal government shutdown drags on, while grain traders are muddling through without a key report on weekly export sales.

http://www.reuters.com/article/2013/10/03/us-usa-fiscal-agriculture-idUSBRE99212H2013100

Review of week 3

What happened 1: There was a huge decrease on corn and soybean at the beginning of week 3. On October 2nd, corn fell 0.46 percent to $4.37 a bushel and soybeans fell 0.28 percent to $12.64. It implied that corn and soybeans remained under pressure from USDA reports released at midday on Monday stating that supplies of the crops were much larger than analysis anticipated. The U.S. corn harvest advanced to 12% complete this week while soybean harvest progress reached 11%, USDA said. Also, USDA reported on Tuesday that exporters had sold 113,000 tonnes of U.S. soybeans to China.

It is said that a record-large corn crop and the fourth largest soybean crop on record pressured corn prices to the a three-year low and soybeans to a 19-month low.

Interestingly, most trade for corn and soybean happened simultaneously and the volume was also quite similar. It implied that people tend to trade during the fluctuation of the price. In my opinion, it is easier to earn some money or cover the loss while the trade volume is at a level sine the price is more unstable and we can buy and sell or short and cover in a very short period.

So, I did this: I gave myself a big relief when I finally sold all of my corn futures and soybean futures on Tuesday. And then, I waited for three days hoping the price of soybean could rise a little so that I can short some soybean futures. But it seems that the price of soybean was already too low to gain money from short positions.

What happened 2: Unlike the sad mood that soybean and corn usually bring to me, I like wheat futures best since by far it is still helping me earn some money from this changing market. Wheat futures is still undergoing the affect of bad expectation on lower output in Argentina, which led its neighbor Brazil to ramp up wheat purchases from the U.S. Brazil’s wheat crop was also damaged by frost. Additionally, top wheat grower China increased imports of U.S. wheat to stem a domestic shortfall.

As you can tell from this graph, the price of wheat futures soared as high as $6.98 – the highest level since June 21.

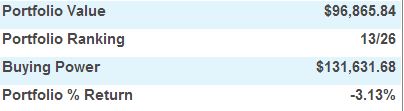

So, I did this: Being a typical risk-averse person, I am worried about the price would going down after hitting the highest point. So unfortunately, I sold 6 unit when the price was fluctuating on Wednesday. Then the remaining 9 units bought me $10,537.5 profit but my portfolio return is now -2.96% since I don’t hold that much futures like week 2.

Lessons for week 3:

- Don’t be regret after ordering. I mean regret cannot change anything except your mood, so think carefully when placing the order. I learnt this because of the low price I sold corn and soybean at. I was planning to sell them on week 2 but there was a little hope that they would rise a little bit. But this week….Just forget it, because I stop bleeding for them.

- Keep calm when the price is fluctuating. A big lesson for this week is that I lost my opportunity profit as I sold almost half of the wheat futures just because it went down a bit. In other words, I don’t believe my research. Try to get used to the fluctuation in future market since it happens all the time.

- Be positive about trading. Well, it seems like a rainy week for trading as all the crop price is going down except wheat. Some is earning a lot while some is losing. I found myself start being afraid of the changing price and always worried about money. That is not good for trading I guess cause that would hold you from trying. So be brave, girl!

As for next week, I would wait for the increase of corn and soybean and short them and get ready for wheat once it starts falling. Try some new things like sugar and coffee, I did trade any this week because I am doing the research and observing the price trend.

Anyway, like the shine outside today, good luck for next week!

Mia