“Could I be classified as assignments, or project will be better, instead of just a game?”

– Mr. Futures

I guess only a few of us traded frequently this week (since the trades made is almost the same as last week).

I guess only a few of us traded frequently this week (since the trades made is almost the same as last week).

As you may notice, there were more discussion about the assignments, projects,video things, case study and midterm…while much much less comments on trading. This phenomenon implied that we are all dedicated people (said this in BBC news style), cheers!

It seems that we are “enjoying” a short vacation in futures market like U.S. government do in the real world.

So, this week I’d like to share:

- Quick news review

- A whole new way to trade

- Review of my portfolio

Quick news review

Be careful with wheat.

Australia’s newly started wheat harvest appears, in its early stages, to be echoing the world trend, with Australian Crop Forecasters hiking its forecast for wheat tonnage, but highlighting disappointment on protein levels.

The wheat production turns out to be higher than the forecast in Australia lifted by some 2.5m tonnes to 25.9m tonnes. This figure was above estimates from the US Department of Agriculture, at 25.5m tonnes, and the International Grains Council, at 25.0m tonnes.

Go sugar, go!

Sugar prices hit their highest in nearly seven months after cane industry officials revealed a 23% tumble in output of the sweetener from Brazil’s key Centre South region, thanks to rains which are continuing to undermine output. It is reported that the drop in sugar production in the last half of September was even larger than that in cane, falling 23% to 2.29m tonnes, as mills diverted more crop to making ethanol rather than the sweetener.

Really good harvest in corn and soybeans.

Corn yields in two major US growing states have come in “at or near record levels, the harvest upgraded by 225m bushels to 13.7bn bushels. The forecast for the soybean yield was also raised, by 0.7 bushels per acre to 41.1 bushels per acre, and the harvest was upgraded by 44m bushels t 3.6bn bushels.

Spreads – a whole new way to trade

We got very good resource about futures trade this week, or let’s say finally we know things about the technical analysis, thanks to Andrew and Mark. I even felt excited after Thursday’s 501 class cause we now have some theory knowledge supporting us to choose a better strategy.

This time, I will go into the Future Spread Trading.

I knew this concept from Laura’s blog and it really attracted me. It introduce a new idea about trading futures – it offers us the opportunity to profit off contract spreads instead of just taking a position on the market’s direction.

When we are trading a spread, we are trading two correlated markets at the same time. It could be intracommodity spread like to long December corn and short July corn or could be intercommodity spread, example can be long March corn and short July wheat. So the main idea here is going LONG in one market and SHORT in another market.

One great thing about trading spreads is that we can take advantage of seasonal supply and demand changes in agriculture commodities and the position has limited exposure to external market forces like natural disasters, international incidents or US gov shutdown. Also, a big advantage here is it can help us to catch the right trade timing.

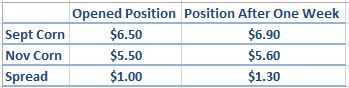

I figured out an example to help us understand the strategy:

Let’s say I have two contracts for corn: September at $6.50/bushel and November for $5.50/bushel. Assume that in your opening position, I’ve bought (long) 100 bushels from the September contract, and sold (short) 100 bushels of the November contract. The spread is now $1.00. Assume that the September contract goes up to $6.90 while the November contract goes up to $5.60. The spread is now $1.30. So I could sell the spread position (short the September contract and long the November contract) and make $0.30 per bushel. In other words, I’ve made a net gain of $40 from buying and then selling the September contracts, while I’ve made a net loss lost $10 from selling and then buying the November contracts. Thus, the net profit would be $30 altogether.

How to use apply this strategy in to our trade game?

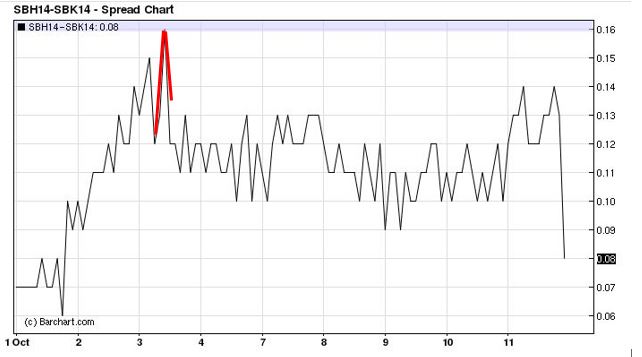

Let’s take sugar #11 as an example (I was planning to trade sugar futures last week, but you know….). Anyway, I’d love to show some preparing work here.

There are two red arrows in the graph above which shows the increasing rates of both March, 2014 Sugar futures and May, 2014 Sugar futures. We can see that between Oct 3rd and 4th, the arrow in March Sugar is much more flat than that in May Sugar, so the spread between these two period will be large and it will be a good time to short March Sugar and long the May Sugar at the same time. Here is the spread graph of SBH14 and SBK14, it shows the same result that we concluded from above graph.

So, we can make a good profit by short March Sugar and long May Sugar simultaneously on Oct 3rd and then buy March Sugar and sell May Sugar on late Oct 3rd. It seems that I missed a great opportunity to make money last week. Well, I think the spread will be more obvious when two correlated futures have different changing trend.

In a word, the point I want to make here is to focus on the relationship between two positions you have and estimate the changing rates of two positions then set the spread order.

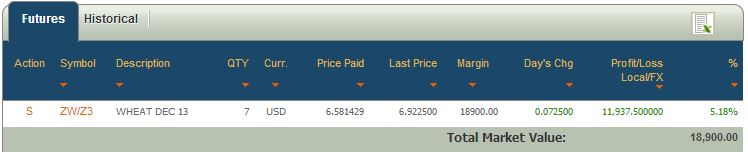

Quick review of my portfolio

Basically, my portfolio behaved quite stable last week and the portfolio return kept negative as I only held one futures – wheat. It seems that it is really difficult to earn money with only one futures even the price is rising. Hope we have more time to focus on interesting trade game next week…

Good luck with assignments, project, case study, midterm AND trade game next week.

Enjoy the Thanksgiving Day and this beautiful Autumn!

Mia