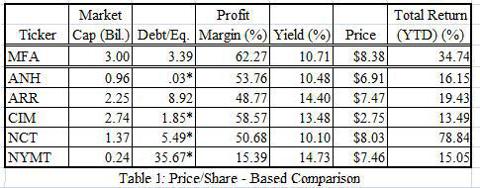

Benefiting from a special tax structure, mREITs are able to avoid burdensome taxes by distributing 90% of corporate profits to shareholders in the form of dividends. These high dividend-yielding stocks, ranging from around 6% to 18% distribution rate have proven to be extremely attractive to investors. Many mREITs like MFA financial (MFA) and Invesco Mortage Capital Inc (IVR) have dividend rates of 10% and 13% as well as 1 year stock growths of 23% and 30% respectively. Stockholders’ compounding of dividends combined with generally speaking attractive yields may result in continuous stock growth despite moments of economic uncertainty.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it. – Albert Einstein

So it does seem as though mREITs are high-yielding investments. But one must wonder what are the risks? mREITs are able to turn profits by borrowing money at a certain rate, say 1%, and then lending it out at a higher rate, say 1.3%. These loans (mortgages) are backed by real estate securities, which allows them to leverage the amount borrowed by more than 5 times the amount of cash they have on hand. This means that a 0.1% increase in interest rates in the economy would lead to shrinking profit margins of many percentage points for leveraged mREITs. mREITs are profitable while interest rates are stable but can be extremely affected  for the worst if interest rates rise or decline by too much. Profit losses for mREITs directly result in a cut in dividend yields, which is usually a SELL sign to investors.

for the worst if interest rates rise or decline by too much. Profit losses for mREITs directly result in a cut in dividend yields, which is usually a SELL sign to investors.

One must therefore be wary of mREITs and keep in mind economic factors that may directly affect interest rates and therefore company performance. The Treasury’s recent quantitative easing policy is one to keep in mind…!