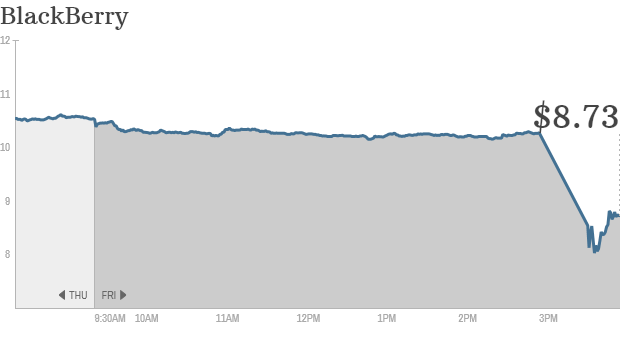

Blackberry is facing a loss of nearly $1billion for the second quarter and has to cut 40% of its global workforce. In addition, Blackberry’s stock is down 26.5% this year. The company is trying to keep itself and its sales afloat as demand for blackberry has been poor.

Reports announced 4,500 jobs cut came about this Friday Sept 20 2013, corroborating the layoff rumors that have been a problem at the smartphone industry. It ascribed to the losses (capital costs) and burden it carries to restructure its business well and re gain increases in its competitiveness in the market.

The operating loss Blackberry is facing is about three times larger than forecasts. One of the key factors contributing to the loss is that the sales of the devices are comparatively poor compared to other smart phones in the market. The demand for the new Blackberry 10 — in which Blackberry has placed so much hope on — is lacking.

The constant bad news on Blackberry may further decrease the demand to its sales. Following trends, the population’s demand for Blackberry smart phones may deteriorate further as everyone stops using it.

Analysts claim that taking the company private would be the best option. There have been rumors that Fairfax Financial Holdings, Blackberry’s largest shareholder, might be interested in taking Blackberry private.

Source: CNN News. “BlackBerry Slashes Staff, Warns of Nearly $1B Loss.” CNNMoney. Cable News Network, 20 Sept. 2013. Web. 22 Sept. 2013. <http://money.cnn.com/2013/09/20/technology/blackberry/index.html?iid=H_T_News>.

Nonetheless, Blackberry is endowed with some profitable patents that may be appealing to potential buyers or partners.

Blackberry’s brand has lost its customer standing as demand for its product has declined. This may negatively affect other business elements starting from Blackberry’s sales to its stocks, revenue and back to damage its brand image. Nevertheless, Blackberry still have a strong reputation in terms of its corporate security.

2 replies on “Billion Dollar (loss) Alert!!!”

Later news; Sept 23 2013 : Blackberry has agreed to be acquired by Fairfax Financial Holdings for $4.7 billion dollars.

Wit reference to class 6 Operational management