Former Windows Chief Steven Sinofsky holds a Surface tablet with skateboard wheels attached to show the strength of the device during the launch event for Microsoft Windows 8 in New York, Oct.25th, 2012

Former Windows Chief Steven Sinofsky holds a Surface tablet with skateboard wheels attached to show the strength of the device during the launch event for Microsoft Windows 8 in New York, Oct.25th, 2012

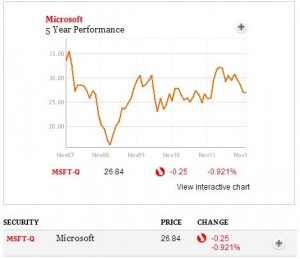

Two weeks ago, Steven Sinofsky, the chief of Windows, helped Windows introduce its latest system Windows 8 and its Surface tabletS. But he unexpectedly announced his departure on November 13th. “Microsoft shares fell by 3% to $27 in early trading on Tuesday as the news reverberated around the web, leaving “Microsofties” themselves stunned as they tried to digest what the change will mean for the company. Sinofsky was “a tremendous talent,” one said on Tuesday.”

Mr Steven Sinofsky has always been viewed as a visionary in Microsoft. He is the leading force in the development of Windows 8 and his success in the Windows division has led many to believe that he would take the place of Microsoft’s CEO.”By leaving, Mr. Sinofsky has drawn negative speculation – not only of tension within Microsoft’s upper ranks, but also of the positioning of Windows’s future within the brand.”

This is supposed to be the big time for Microsoft since its newest product Window 8 and Surface tablets have just faced the public yet this news is failing people’s expectations about Microsoft. What surprises me is that many people are still buying Microsoft’s stocks despite the shares are now dropping. And why is that? (the video below:” bad news for Microsoft is also good news for investors” provides an explanation for this phenomenon)

This reminds me of the COMM 101 finance class that we had recently. In the COMM 101 class, we discussed the Google stock-price case. The early release of Google’s earning caused its share price to drop tremendously. This is because the price of the stock is not heavily determined by investor’s expectations about the future earnings. More importantly, the price of the stock is determined by the company’s cash flow. And news on Cash Flow will turn cash flow into prices; Google missed its estimate on its earnings! (Earnings and cash flows are related) So if the earnings is less than expectation then the cash flow of the company is very likely to fall in the future. As a result, people do not want Google Stock anymore. Investors buy stocks for the future possible value and they bet on the future growth in stock price. That’s why Google’s price went down after the early release of the financial report; it was not up to the expectations of the investors.

In this case, Microsoft is a huge company and it is gaining profit at a fast speed from its newest Windows 8 and Surface Tablets. At the same time, it has a temporary low stock price due to departure of Sinofsky. What time is better to purchase its shares than now? It is estimated by many analysts that Microsoft’s stock price will go up soon in the recent few weeks and now would be the perfect time for investors to purchase the share in this large company.

Microsoft’s performance in recent years

Microsoft’s performance in recent years

News Source: Microsoft stock sheds 4% after Windows boss departs(the Globe and Mail)

News Sources:Windows chief Steven Sinofsky pushed out of Microsoft

Recent Comments