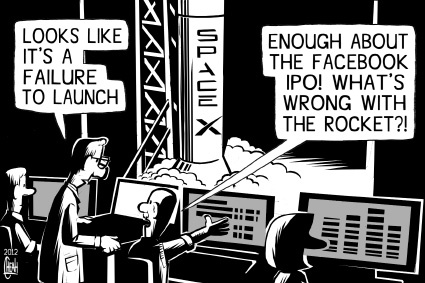

Since Facebook’s eagerly awaited initial public offering (IPO) of $38.00 (U.S.) per share on May 18th, its shares have fallen to $20.28 (U.S.) each. How did this happen to such a dominant social networking service in just four months?

Facebook’s crisis arguably started when General Motors Co. announced it would be removing its paid ads from Facebook because “it didn’t believe advertising on the site was effective.” Two days later, when Facebook’s IPO began, it immediately started dropping. This further hurt Facebook as other marketing firms began to doubt it as a viable place for advertising.

In just three months, Facebook fell from a near-hundred billion dollar “social media darling” to $46-billion (U.S.). In a desperate bid for advertising, Facebook “began experimenting with ads that pop up in user’s Facebook feeds – even if they haven’t agreed to accept messages from that advertiser.”

Recently, Facebook has taken a major blow from the financial journal, Barron, which stated that “the company is overvalued and may drop to $15.00 (U.S.) a share or lower.” Facebook’s shares fell up to 11%.

As of September 25, 2012, Facebook shares are worth $20.28 (U.S.) each.

Is the stock a buy? Right now, I don’t think so.

References:

https://www.google.ca/finance?client=ob&q=NASDAQ:FB

http://www.economist.com/node/21554532

https://secure.globeadvisor.com/servlet/ArticleNews/story/gam/20120818/RBSOCIALCOVER0817ATL

http://www.bbc.co.uk/news/technology-19699205

http://www.toonpool.com/user/5624/files/space_x_launch_1687755.jpg