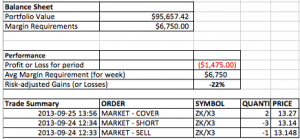

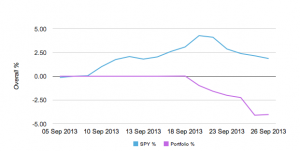

Another busy week has gone, but the situation is not so good for my trading, because I am still involved in the trade of soybean with a negative return. (The graphs presented below is my portfolio summary.)

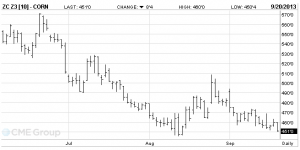

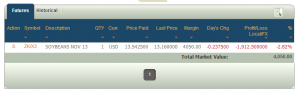

According to the news, due to area expansion and the weather condition, the estimated yield of soybean is going up. Usually, the production and supply have great impact on the price, therefore, I decided to short a couple of units because of my expectation on a falling tendency. Then, I faced the dilemma that short order must not conflict with an existing “long” position. That is to say, I had to sell the soybean I bought before with negative profit, and definitely I would lose a lot of money. But I did want to seize the opportunity to earn more, since the expected production showed quite a certain trend of decline on soybean price. I pulled out to short, which caused me a loss at $1985 for just 1 unit (bought it at $13.54). The next day after I made the deal, I found it was an extremely bad decision, because the price of soybean started growing up, which totally went the opposite direction as expected…dilemma again, pull out or calm down? I suffer another loss at $1245 when I decided to cover two of contracts to make a clearance. This week sucked, I stopped trading after these tremendous loss and I am still figuring out the plan for next week. (The graph below shows the price trend of soybean.)

So what I learned from this week? I think I cannot trust so much on the effect of supply on the future price, because the estimated supply is also figured out by uncertainty. When I use uncertainty to predict the future, the outcome will be definitely uncertain. Also, I am supposed to focus on micro and macro (no longer yield-oriented prediction only and pay attention to other factors). As a trader making money off of price movements, maybe I can just focus on the movement of price to make a quick money (like what we do on stock). Additionally, in order to lower the risk, I should no longer put all my eggs on a basket. Hope I can make a break-even next week.

BTW, share a new place to get agricultural news which I believe is better than Bloomberg.

Here you go:

http://www.agrimoney.com/1/commodities/.

Good luck next week!