Microfinance is having a comeback in India, but how not to screw it up?

When microfinance was introduced, it gave those in poverty a chance to get out. It worked… until millions began applying for loans, and uninformed lenders lent to anyone.

-

-

http://www.givingwhatwecan.org/sites/givingwhatwecan.org/files/microfinance_558605.jpg

The result: thousands of households producing the same goods, creating surpluses, and driving prices so low that households could not make enough money to pay back their loans. A slayer of poverty has put millions deeper in poverty because lenders and borrowers did not assess the market.

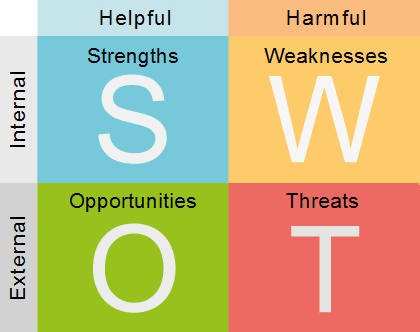

I think the only way to make microfinance work is to know the surroundings. It is simple and there are many tools to help evaluate. SWOT analysis done by the borrowers will provide a clear picture of what is the best direction to take his/her talents by telling borrowers what they are talented in doing. PEST analysis done by the lenders could let them know what the overall markets look like, and which markets are better for expansion, so they know who to lend to. It is just that quick and simple!

-

-

http://cdn2.hubspot.net/hub/55403/file-1489789351-png/images/swot.png?t=1413393797511