On July 1st, 2008, the Canadian province of British Columbia (BC) enacted North America’s first broad-based carbon tax designed to reduce greenhouse gas emissions (GHG). To support understanding of carbon policy in British Columbia, I will introduce some background and contextual information on carbon policy first.

1. The definition of GHG:

GHG refers to the six greenhouse gases included under the international Kyoto Protocol carbon dioxide, methane, nitrous oxide, nitrogen triflouride, sulphur hexafluoride, hydrofluorocarbons and perfluorocarbons.

2. Carbon Policy: carbon tax and cap-and-trade.

1) Carbon Tax is more about ‘Price’. According to BC Ministry of Environment, ‘the carbon tax puts a direct price on each tonne of carbon (or GHG emitted) thereby sending a price signal that will, over time, elicit a market response across the economy to reduce carbon emissions.

2) Carbon cap and trade system is more about ‘Quantity’. According to BC Ministry of Environment, the carbon cap system sets an absolute limit on the quantity of carbon emissions across specified industrial sectors. At the same time, the permits for each tonne of carbon emissions that specified industrial sectors get can be sold and transferred within the system.

Based on the environmental economic models we learned before, the below diagram can provide a clear picture of how does the carbon policy work.

A Model with A Single Polluting Firm

Consider a polluting firm that facts an increasing marginal pollution abatement cost curve. The benefit-cost analysis has determined that optimal abatement occurs at e* where the marginal benefit and marginal cost curves intersect.

Carbon Policy–Tax:

If carbon abatement < e*, the tax bill (A+B) > the marginal abatement cost bill (B), the firm will choose to abate instead of paying the tax.

If carbon abatement >e*, the tax bill (D)< the marginal abatement cost bill (C+D), the firm will choose to pay the tax and continue to pollute. In this situation, the abatement cost to this pollution firm=B+C+D and the government can get tax revenue=D

Carbon Policy–Carbon Cap:

The abatement cost to the pollution firm=B and government cannot get revenue.

A Model with Two Polluting Firms

The two-panel diagram illustrates two different increasing marginal abatement costs. The intersection of the two marginal abatement costs is where economic efficiency achieved. (“equimarginal principle).

Carbon Policy–Carbon Tax:

To abate the emissions to e*, the highest cost firm: tax bill(B+C+F+G) and abatement costs(K)

the low cost firm: tax bill(C+G) and abatement costs(J+K)

Carbon Policy–Carbon Cap-and-Trade:

A carbon cap is set by issuing carbon permits to polluting firms. The abatement cost to the low abatement cost firm=C and to the high abatement cost firm=D+F+G+K. We can suppose that the blue line is a a demand curve for permits and the green line is a supply curve for permits. Trading will reduce overall abatement costs by area D+F. And in this policy, the abatement cost to the pollution firms equals to that of tax policy, is C+G+K

The carbon tax and carbon cap-and-trade can achieve the same level of efficiency by achieving the optimal abatement level at the minimum cost. But the distributional implications are different, the firm can lower the cost through carbon cap-and-trade and the government can get tax tax revenue with a carbon tax. Form the second model, we know that the carbon policy can encourage the firms to adopt new technology to lower the marginal abatement cost.

The above analysis shows the theoretical side of carbon policy, now we will look at the real-life example of implementing carbon pricing policy in BC, Canada in the following paragraphs.

A. Carbon Tax: B.C. carbon tax costs increase at a rate of $5 per tonne of CO2 emitted per year from the initial level of $10 per tonne in 2008 up to $30 per tonne in 2012. the carbon tax is applied indiscriminately across industrial sectors and households solely based on the carbon intensity of the fuel type, which means the taxpayers pay the same on every unit of emission.

Problem:The carbon tax can lead to an increase in fuel price. Because BC has among the highest levels of poverty and inequality in Canada, a pressing concern is the potential for unfair impacts of carbon pricing on the poorest.. It is easy for the rich people to make adjustment on their consumption proportion. However, it is hard for the poorer to adapt to.

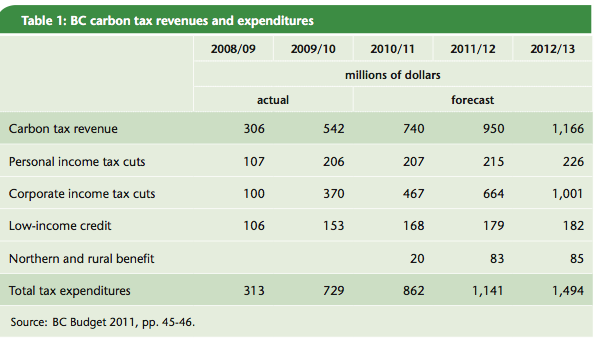

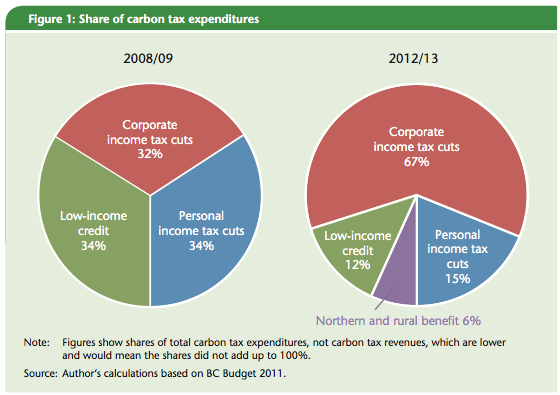

BC Solution: The BC government’s policy of “revenue neutrality” requires all carbon tax revenues to be transferred back to British Columbians in the form of personal and corporate income tax cuts, and credits for low-income households.

<New problem>: According to Marc Lee (2011) , ‘BC’s carbon tax regime has in fact been revenue negative—the value of tax cuts and credits has exceeded carbon tax revenues, primarily due to corporate income tax cuts.’ and also the low-income credit part is decreasing.

The distribution of the tax revenue return is not appropriate, because most of the revenue are transferred to corporate income tax cuts in the future. That means the policy of revenue neutrality cannot achieve the goal of lowering the negative affect on low-income household or person. This will result in poorest’s resistance to this policy.

B. Carbon Cap-and-Trade: B.C. is working with the Western Climate Initiative (WCI) partner jurisdictions to create a regional carbon market across a diverse set of emission sources.

Problem: The larger the carbon market, the greater the range of emission reduction opportunities available to emitters and the lower the cost of compliance. However, I think this market is not very stable and cannot work very well, there are many jurisdictions joint at the beginning, but many quit already.

Here is the detailed information on carbon policy Coverage:

In B.C., “downstream” combustion of gasoline, diesel, marine and aviation fuels and residential, commercial and industrial (below the cap and trade compliance threshold) use of natural gas, propane and home heating oil would not fall under the cap and trade program as they would continue to be subject to the province’s carbon tax.

The BC carbon tax covers about 73% of domestic GHG emissions and the remaining 27% come from non-combustion sources including industrial processes. I think the coverage should be extended in the future.

In all words, I think BC are trying to make comprehensive carbon pricing policy to control the GHG emissions by making creative policy. I appreciate this action. At the same time, I think there are always some gaps between plan and reality. When applying this policy to really life, the externality of this policy should be considered, especially from disadvantaged groups’ side.

References:

http://www.ldlc.on.ca/uploads/2/7/8/8/2788943/ccpa-bc_fair_effective_carbon_full_2.pdf

http://www.env.gov.bc.ca/cas/mitigation/ggrcta/pdf/carbon-pricing-bg.pdf

http://www.fin.gov.bc.ca/tbs/tp/climate/carbon_tax.htm

http://www.env-econ.net/carbon_tax_vs_capandtrade.html