Hong Kong is one of the most crowded places in the world. With more than 7 million citizens and thousands of tourists living in 1000 square kilometers, traffic congestion is considered a huge problem in Hong Kong’s urban development.[1] In order to solve the problem, Hong Kong government has proposed many traffic policies since 1980. Hong Kong is also the first jurisdiction to propose the Electronic Road Pricing (ERP) in the world. Interestingly, the ERP scheme is never launched in Hong Kong due to the lack of stakeholder support and the instability of policy environment during that time. Besides the ERP, Hong Kong also proposed other policies such as vehicle ownership control and vehicle use control, which were launched in terms of high tax or tolls and had achieved extraordinary success in reducing traffic congestion. I will discuss about these two policies in the following paragraphs.

1. First Registration Tax (FRT)

Hong Kong has a highly developed public transportation system, which covers over 90% of passengers’ daily journeys.[2] Among all the public transportation, Mass Transit Railway and buses are the most popular ones. It can be said that the traffic system in Hong Kong has almost reached its upper limit that no more vehicles should be allowed on the road. Since public transportation can not be reduced, the only method to manage traffic congestion is to control the number of private cars.

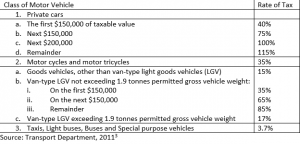

To control the growth of private cars, the government has introduced a First Registration Tax (FRT) as early as 1974. The tax, charged when the vehicle is first registered in Hong Kong, has been increasing since then and is particularly for private cars. Following is the list of First Registration Tax in Hong Kong in 2011.[3]

From the table, we can see that the taxes are mostly imposed on private cars and motor cycles, and the more expensive the cars, the higher the taxes. Some of the public transportation, such as taxis and buses, are also covered in the FRT system but their taxes are very low.

I can not find enough information about the distribution of tax revenue, but we can detect from the table above that most FRT is paid by rich people since only rich people will register expensive private cars. The tax for buses is extremely low, indicating that public transportation which is in service for most middle class and poor people, is almost tax free. In this taxing system, poor people are benefited while rich people are paying for most of the congestion cost.

Effectiveness

According to the research done by Mahmud Hassan TALUKDAR, the growth rate of private cars had experienced a rapid drop due to the imposition of FRT in 1974. The growth of registered private cars was 15.8%, 14%, 14% and 7.4% from 1970 to 1974 respectively. And the growth of private cars was -8.0%, -4.2% and 0.5% from 1974 to 1976 respectively. The fact shows a strong impact of the tax. However, it is unclear to what extent this policy has reduced the traffic congestion, because Hong Kong also implemented a 21-month congestion charging pilot from July 1983 to March 1985.[4] We could only assume from the growth rate of private vehicles that the number of cars on the road was effectively controlled, so the policy is considered effective.

2. Tunnels Tolls

In addition to the FRT, Hong Kong government also implemented other policies to reduce the traffic congestion. For instance, tunnel tolls are charged in most road tunnels. Hong Kong consists of many islands, which are connected by more than 20 tunnels and bridges. The queues of traffic waiting for the over-capacity tunnel and bridges have blocked the adjacent traffic network and created a huge congestion problem.[5] The major tunnel tolls for major vehicles are summarized in the table below:

| Vehicle type | Cross Harbour Tunnel | Eastern Harbour Crossing | Western Harbour Crossing | Tate’s Cairn Tunnel | Tai Lam Tunnel | Lantau Link # |

| Motor cycles | $8 | $13 | $25+ | $13 | $20+ | $20 |

| Private cars | $20 | $25 | $55+ | $17 | $36+ | $30 |

| Taxis | $10 | $25 | $50+ | $17 | $36+ | $30 |

| Public light buses | $10 | $38 | $65+ | $23 | $100+ | $40 |

| Private light busses | $10 | $38 | $65+ | $24 | $100+ | $40 |

| Light goods vehicles | $15 | $38 | $65+ | $24 | $38+ | $40 |

| Medium goods vehicles | $20 | $50 | $90+ | $28 | $43+ | $50 |

| Heavy goods vehicles | $30 | $75 | $120+ | $28 | $48+ | $80 |

| Single-decked buses | $10 | $50 | $100+ | $31 | $115+ | $40 |

| Double-decked buses | $15 | $75 | $140+ | $34 | $135+ | $60 |

| Each additional axle in excess of two | $10 | $25 | $30+ | $21 | Free of charge+ | – |

Source: Transport Department[6]

We can see that the tunnel tolls have covered all vehicles that need to cross the tunnels, regardless of private or public. But if we look at a per capita level, we can find that the fees per capita for small vehicles are higher than those for large vehicles, which again shows a fair distribution effect that rich people need to pay more for the traffic congestion than the poor.

Effectiveness

The tunnel tolls was imposed since 1984. According to Mahmud Hassan TALUKDAR’s research, the tunnel tolls on the cross Harbor tunnel successfully reduced car and taxi goods traffic by about 15% and light goods vehicles traffic by about 13%. Overall, this policy is considered effective.

Conclusion and suggestion

Hong Kong is a crowed city with most of the roads are small two lanes roads, implying a continuous urgent in congestion management. After years of effort, traffic pricing policies in Hong Kong have achieved great success in private vehicle ownership control and congestion reduction. Successful policies include FRT, tunnel tolls and ERP. Other policies include fuel tax and parking control, which are controversial due to their effectiveness on congestion and side-effect, such as increasing illegal parking. To conclude, Hong Kong government should continue implementing FRT and tunnel tolls. Moreover, pursue more support for the implementation of ERP.

[1] http://countryeconomy.com/countries/compare/canada/hong-kong

[2] http://en.wikipedia.org/wiki/Transport_in_Hong_Kong

[3] TALUKDAR, Mahmud Hassan. “Transport Pricing Policy In Hong Kong.”Management Research and Practice 2 (2013): 30.

[4] Pike, Ed. “Congestion Charging: Challenges and Opportunities.” (2010).

[5] TALUKDAR, Mahmud Hassan. “Transport Pricing Policy In Hong Kong.”Management Research and Practice 2 (2013): 30.

[6]http://www.td.gov.hk/en/transport_in_hong_kong/tunnels_and_bridges/toll_rates_of_road_tunnels_and_lantau_link/index.html