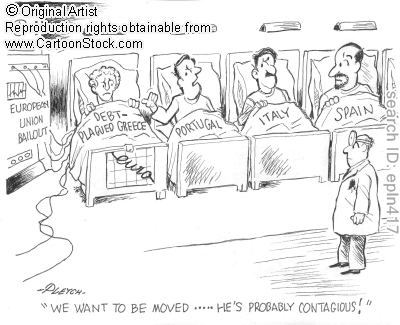

Reading Eric Lee’s post has informed me about the severity of the Euro crisis. He noted how a) France and Germany had begun talks of recapitalization, but have not told the specifics or plans and b) Europeans are starting to notice the decline of Euros.

In class, we learned that as uncertainty or risk rises, the cost of money rises. Since Greece’s has been rolling on interest for a while, it’s getting costly for them to continue borrowing money. The bailouts have barely helped and many economists think the Eurozone may already have sunk into recession.

The question now is, how long should countries keep bailing out Greece? The IMF had estimated a cost of at least 100 billion euros to help Europe’s banks; and currently, the European Central Bank is the only institute that can help.

Perhaps now, besides Eric’s conclusion of waiting for France and Germany’s action, the solution would be to follow Germany — print old currency in preparation to leave the euro. By printing deutsche marks, Germany expects export prices to jump as a result of leaving euro; but German industries seem capable of handling the price increases. They just want to leave the crisis in one piece.