Bitcoin was established in 2009. Many people would point out the fact that the era it was established in was tech savvy and more importantly tech friendly. However, bitcoin was born in an era of ignorance about crypto-currency. It identified a “pain” that was oblivious to consumers and set out to solve it. This was the mission statement set out by the founder of the digital currency who referred to it as a “pain killer”.

Bitcoin gained popularity in 2016 with increasing knowledge about crypto-currency.

Fast forward nearly 8 years and the platform has done wonders. Its incredibly secure design has gained the trust of consumers and the sheer speed of transactions has left financial institutions baffled. Add to it the opportunity for third parties to earn money through authorizing transactions in a decentralized transaction system, it has received an astounding reception. So much so that a single bitcoin has hit a high of being worth $7800. Even through all the positivity, some observers have raised the concern that this is too good to be true.

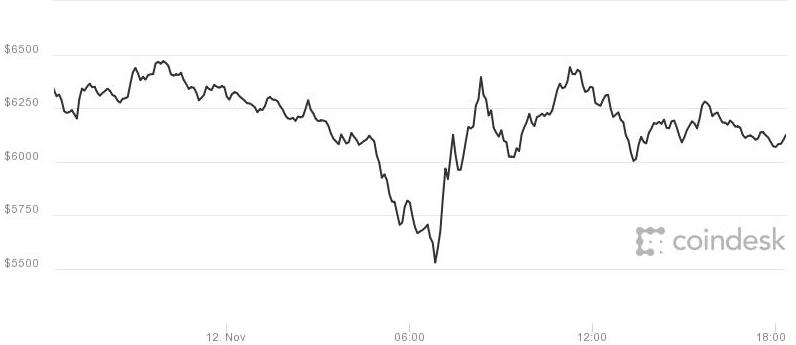

And there concerns may well be validated. The past weekend has seen bitcoin lose over 25% in value, falling from a high of $7800 to nearly $5900. Why has this happened? An intrigued individual might ask. The answer is simple. Bitcoin’s entire Value Proposition is that transactions happen rapidly without delays. This has been put into jeopardy by the fast paced growth of the currency itself. Bitcoin has a hard-cap of 1 megabyte of space per block which was fine with a small number of transactions. However, since the number is increasing rapidly, the current model is not efficient as it only allows for seven transactions per second.

Whats worse is that Bitcoin’s nearest rival, Bitcoin Cash, has doubled in value through the past four days reaching a value of more than $1500. This comes as no surprise as the civil war between these currencies is an old one. Bitcoin Cash offers faster transaction services with lower fees but takes away some of the decentralization from the process, something proponents of Bitcoin have continuously highlighted. They argue that this makes Bitcoin Cash like any other currency, volatile and not a safe way of preserving wealth.

The shakiness of both major crypto-currencies can possibly be traced to the fact that developers are uncertain over which version will be the primary version of digital currencies. However, one statement can be said with reasoned deduction. Even if minute details about these currencies are fixed and code rewritten, skepticism from the financial world will haunt Bitcoin. Banks, among other large corporations, use the media to establish an anti-bitcoin culture which is detrimental to future prospects. Thus, optimists and investors in Bitcoin will also need to fire back with marketing and research that cements Bitcoin as the currency of the future.

Word Count: 454

Works Cited:

Hoang,M. (2017, October 15). What is the deal with Bitcoin anyway?

Retrieved November 12, 2017, from https://blogs.ubc.ca/markhoang/2017/10/15/bitcoin/

Lee,T. (2017, November 11). Bitcoin rival doubles in price in four days as Bitcoin price slumps

Retrieved November 12, 2017, from https://arstechnica.com/tech-policy/2017/11/bitcoin-rival-doubles-in-price-in-four-days-as-bitcoin-price-slumps/

Dhaliwal,S. (2017, November 12). A Tale of Two Bitcoins: Where Bitcoin and Bitcoin Cash Are Headed

Retrieved November 12, 2017, from https://cointelegraph.com/news/a-tale-of-two-bitcoins-where-bitcoin-bitcoin-cash-are-headed

Cheng. E. (2017, November 12). Bitcoin briefly drops 15% in rocky weekend amid controversy over digital currency’s future

Retrieved November 12, 2017 from https://www.cnbc.com/2017/11/12/bitcoin-briefly-drops-15-percent-amid-debate-over-digital-currencys-future.html