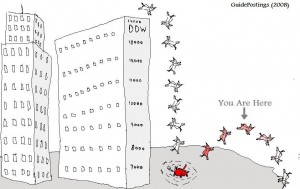

“Bigger dead cat bounce expected today” reads the headline on Agriculture.com today, continuing: “For those of us watching the ‘dead cat bounce‘ for a clue as to when to sell, it has been a crazy world the past couple of weeks. If you are confused by market action, do not feel alone.”

But don’t worry, dead cat bounce is just one of the many strange terms in technical analysis. It refers to a temporary respite in a downward trend, followed by a return to a downward trend. Why dead cat? Why not dead bunny or dead gerbil or even something not dead? I don’t know, but it probably has something to do with finance being controlled by men in their 20’s.

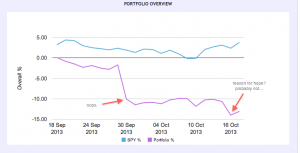

But let’s move on from dead cats, please. This week, the US government came back to life, with President Obama signing the funding bill close to midnight on Tuesday. My plan to hold all my long positions in hopes that the gov’t reopen would shoot prices up up and away failed to materialize when the grain exchange decided they still do not care about the government.

So my grand plan to simply ignore my portfolio didn’t really work out, and I’m still negative, although wheat is pulling back out of the red at least.

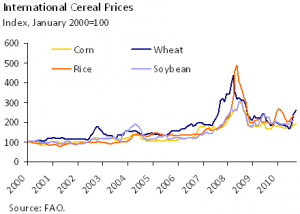

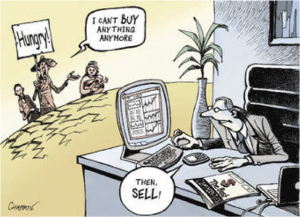

But I’d like to switch gears a bit. We’re currently at the midpoint of our semester, and we’re nearing the end of this trading game. And I’d like to ask: Why are we all struggling so much to make money? How does the market set prices if it’s not due to actual information? A paper in the Journal of Agricultural Economics from 2012 entitled “How to Understand High Food Prices” contends that speculators in the commodities market drive prices without any inherent justification. In fact, the paper goes as far as to say that speculators actually played a bigger role in the 2008 food crisis than actual food shortages or increased demand from biofuel. So this has gotten me thinking, are speculators making the world better, or worse? And what responsibility do we have, as budding agricultural economists, to criticize a system that makes it harder for people to afford food?

That is the thing that has been missing most obviously in any of our discussions of futures markets- consumers. And not consumers like us where we just go to the market and buy some cereal or bread and it’s fine, but consumers at the margins- those living off $2 a day or less- or even the 30 million Americans who are food insecure. When the price of corn futures spikes up, what does that actually mean? Not just for our portfolios but for the people who are unsure if they can afford food tomorrow?

I think we’ve gotten the point of the game- futures prices are volatile and are affected by current events as well as other exogenous factors- but it’s time to start talking about whether or not it’s a good thing, and what the big picture purpose is.

2 replies on “WTF is a “dead cat bounce” and further issues”

Hi Ariel,

Really good points. Starting next wk, Jim will start covering the linkage between commodity prices, which will lead very naturally into the food vs fuel debate. The framework he introduces will give everyone a foundation upon which to experiment with inter-commodity spreads and understand the relationships better. Let’s also set aside some lab time in the following weeks after wk 6 review to discuss some of these issues, lets use next week to come up with some discussion topics. Thanks

-Mark

Couldn’t agree more Ariel! Much like you, I am much more interested in the effect trading has on daily price volatility and strongly believe that someone, somewhere must be paying for that volatility. This is the perpetual problem with macroeconomics as we all know that what is good for the goose is not always good for the gander. A socialist at heart, I am troubled by the potential implications. As with all economic theories however, I am guessing that there is likely not a straightforward answer to the simple question of ‘does futures trading affect food security, and does it disproportionately affect those who are poor?’. Very well written! Love the dead cat bounce too. WTF indeed!