This is the last week of our trading game, so it is the time for us to say goodbye.

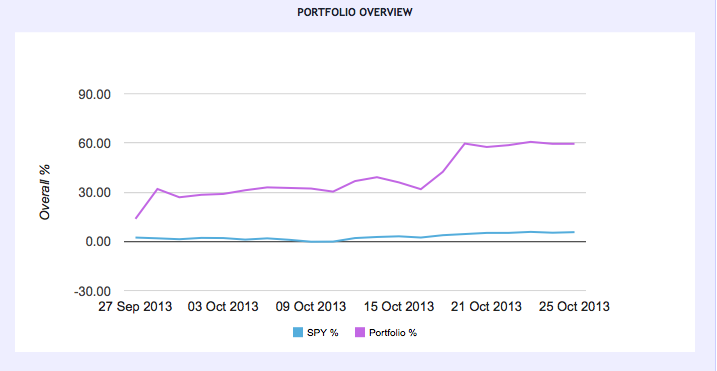

My portfolio value at the ending of this week is $159,506.51. The overall return is 59.51%. It is much higher than the interest of the government bonds and the return of mutual funds. Thus, I guess that my performance is not bad.

What I learnt from trading game

Reading finance news and the reports from USDA are important. In the first week of the trading game, I read the news and knew that China had huge demand of importing wheat. Therefore, I decided to long the wheat. During these six weeks, the price of wheat has spiked a lot, so more than half of my return was contributed by wheat. In addition, from USDA’s report, I knew that the projected yield of soybean in this year is relatively high, compared to the history data. I shorted the soybean and get almost $19,000 return.

Therefore, I decided to long the wheat. During these six weeks, the price of wheat has spiked a lot, so more than half of my return was contributed by wheat. In addition, from USDA’s report, I knew that the projected yield of soybean in this year is relatively high, compared to the history data. I shorted the soybean and get almost $19,000 return.

Understanding how to do the technical analysis is really helpful.During these weeks, I learnt a little bit knowledge about how to analyze the market based on candlestick chart. This helps me to decide when is the best time to long or to short certain commodities. Because of this technical analysis, I could long commodities at relatively low prices and short them at relatively high prices.

Ration is a virtue of making the trading decision. I lose $11,075 on my corn future.  There are several reasons that can explain this huge loss. First, before I longed corn, I never did any research and analysis, so I made a decision impulsively. Secondly, I always wanted to get more profits, even though I knew it was not a good time to hold the corn after I did the research. Thus, I missed many opportunities to sell it at a good price. Furthermore, I was afraid of suffering more loss so that I sold my corn at really low price, although I felt the price would rebound a little bit after its price collapsed. It is important that a good trader should be rational.

There are several reasons that can explain this huge loss. First, before I longed corn, I never did any research and analysis, so I made a decision impulsively. Secondly, I always wanted to get more profits, even though I knew it was not a good time to hold the corn after I did the research. Thus, I missed many opportunities to sell it at a good price. Furthermore, I was afraid of suffering more loss so that I sold my corn at really low price, although I felt the price would rebound a little bit after its price collapsed. It is important that a good trader should be rational.

Hedge is a good way to reduce the risk? I put a question mark on this, because I am not  sure whether the investors with limited money can reduce their investing risk through hedge or not. As an investor with limited money, his/her return is limited as well. At the same time, hedge will decrease their limited return further; sometimes it even causes negative return in reality. Theoretically, hedge may be a good strategy to reduce price risk. In practical, I doubt that.

sure whether the investors with limited money can reduce their investing risk through hedge or not. As an investor with limited money, his/her return is limited as well. At the same time, hedge will decrease their limited return further; sometimes it even causes negative return in reality. Theoretically, hedge may be a good strategy to reduce price risk. In practical, I doubt that.

I don’t have much to say for this week’s blog. This is a terrible week for me. My life is kind of messed up. To be honest, I can’t concentrate on doing anything. I hope I will have a better week next week.