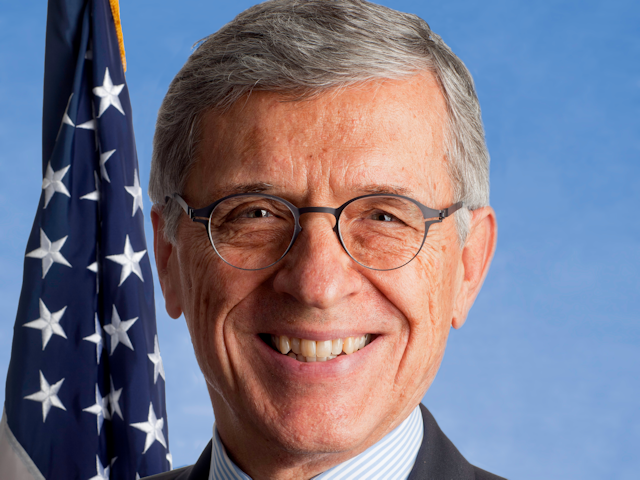

FCC Chair Tom Wheeler – Photo from Wikipedia

The FCC Chair’s announcement this week to redefine what constitutes a multichannel video programming distributor (M.V.P.D) was described as a measure to increase competition to counteract the consolidation of content producers and distributors. I believe that the ramifications of this policy–should it be enacted–will have a significant impact not just on the distributors–which are the target–but on the way that content is produced.

By reducing the barriers to entry, the industry becomes more prone to disruptive innovation, which may produce alternative revenue models. Traditionally, content has used advertising during live-air broadcasts to cover production costs, and then sought lucrative syndication agreements after a certain threshold of episodes. I see this model as unsustainable in an era where content is increasingly available on-demand and distributed through the internet, primarily because the networks that purchase syndication rights to fill their air-time, become obsolete when that content catalogue can be accessed at any time.

To compete for market share firms will need to either wage a price war, or increase their points of difference. I think that the latter is likelier, and that differentiation will be created through exclusive original content. Thus customers will be acquired through interest in specific shows, which will result in more selective choice than is possible in the current era of channel bundling.