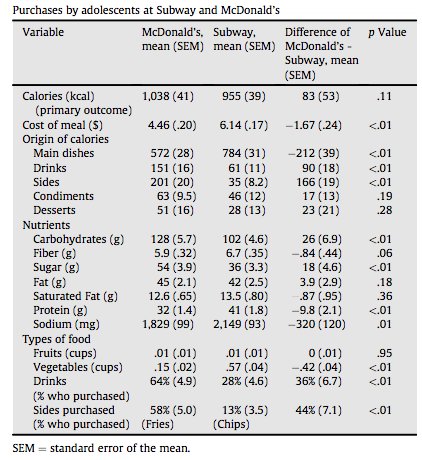

It does not come as a surprise that we consume more calories than we think when we eat so-called “healthier” options. In particular, Subway markets themselves as a healthier option of fast-food by offering different types of bread and low-calorie sandwiches. However, the biggest underestimates of calories are also at Subway with a 20-25% discrepancy, and for teens, an underestimation averaging 500 calories. This proves that Subway’s marketing of healthy sandwiches is working, even though a study shows that the calorie difference between McDonald’s and Subway is quite small. Subway has positioned themselves in consumer minds as a way to eat healthier but still be satisfied, so consumers unknowingly order many toppings or larger amounts that add calories. In that case, there is a possibility of consuming more calories at Subway than McDonald’s, depending on what you order.

What works to Subway’s advantage is that consumers hardly change their behaviours even after seeing the calories on nutrition labels on menus. Instead, using pictures or other marketing tactics to let consumers know which options have fewer calories than the rest works better. Can it be considered unethical? I would say that it is the responsibility of consumers to pay attention to their health and deceptive marketing, though most (like me) probably prefer stimulating their taste buds.