Yes, I know, Gold is impossible to value, too many factors involved, too complex…. Yadda, yadda, yadda…..

Well, without too much time, stress, or serious thought, I feel pretty good about having completed a fairly reasonable valuation of Gold. I could write on the topic for days and days, but am not really properly incentivezed to do so~

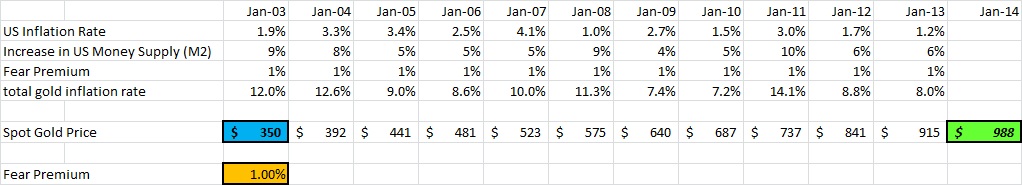

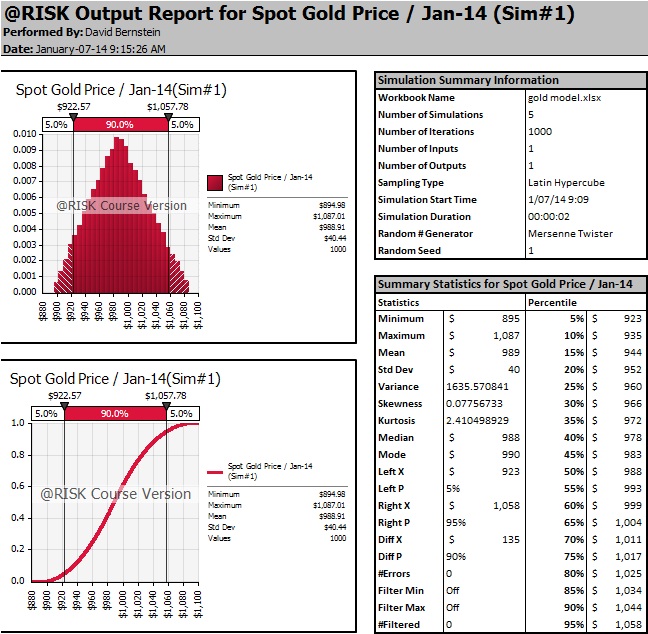

However, I will explain my methodology. I took gold prices from the most recent economically stable time period (before gold went vertical) and compounded it by a “gold inflation rate” equal to actual US inflation + increase in US money supply as these were the 2 clear catalysts for increasing gold prices over the past decade. I then tacked on a fear premium which ranged from 0-2% per year (just to keep the gold bugs happy), and completed a monte carlo simulation on this number since it was the only assumption used. My results show a mean price for gold of $988 and a 90% probability that the fair value of gold according to my methodology rests between $922 and $1058.

And then there is the macroeconomic view of gold, which is absolutely horrible, but I will let the economists out there cover this area.

In other words, gold likely still has another 10% to 20% to fall before a bottom can even somewhat rationally be discussed.

Please see model and charts below and feel free to reach out if you have any questions.

If you enjoyed this article please feel free to donate Bitcoin. I am also available to complete consulting projects and am willing take requests for research projects in return for bitcoin.

Follow

Follow

M0 is just currency… I think you’ve missed all of QE in your analysis.

i used M2 – my mistake for not updating – thx for catching my typo