As a GIS Analyst with Milliman Watkins Practice in San Francisco from Sept. 2018- June 2020, I got the chance to work on a wide variety of interesting projects relating to flood risk and flood insurance. During my time with Milliman, I made daily use of Python, SAS, SQL and ArcGIS Pro for my work. The fast paced consulting environment and diverse array of internal projects to work on allowed me to progress these skill sets tremendously.

Providing GIS support on a wide variety of projects, including:

- A prebuilt flood plan that is based on a query-able grid dataset that covers the U.S. at varying resolutions.

- An API that provides fast and accurate geographic data related to insurance rating from input location data.

- A web-based market analysis tool that incorporates insurance-specific data with geospatial information.

In addition to the GIS provided for the projects referenced above, during my time with Milliman, I performed research and provided support for a research paper funded by the Society of Actuaries, as well as an internal Milliman White Paper.

Residential Flood Risk in the United States:

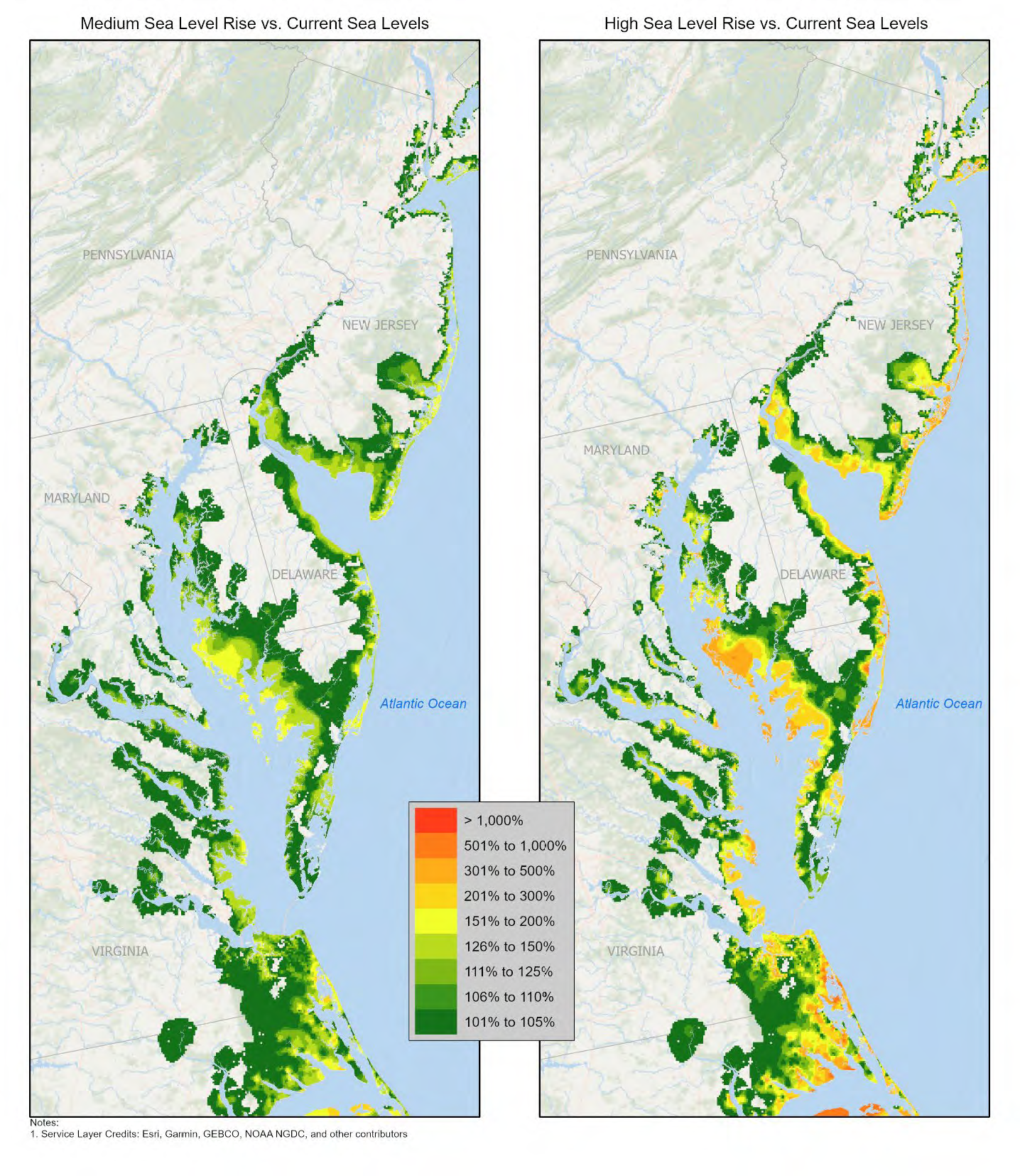

Quantifying Flood Losses, Mortgage Risk and Sea Level Rise

Figure 7: Increase in Total Flood Losses: High vs. Medium Sea level Scenarios, Middle Atlantic States. Source: Residential Flood Risk in the United States. 2020 Society of Actuaries. Page 22.

Findings Include:

- Building losses to single-family residences due to flood are expected to cost more than $7 billion annually, and

more than 87% of those losses are estimated to be uninsured by the National Flood Insurance Program. - We estimate that sea level rise will increase total storm surge losses 21%

by 2050 in our medium sea level rise scenario, and 66% in our high sea level rise scenario.

Key Responsibilities:

- Integrating mortgage data with catastrophe model output.

- Summarizing data by Metropolitan Statistical Area (MSA) in tabular format.

- Interpolating catastrophe model output into raster format for visualization.

Climate Change is making Americans anxious. Insurers can help.

Quote provided by https://www.milliman.com/en/insight/climate-change-is-making-americans-anxious-insurers-can-help: