Newell Acquisition

I just read the newspaper about the acquisition of the newell company. As a finance major student, I get interested in this topic.

“Newellization” Process: requires skills in acquisition and restructuring. This process involves expertise information sharing, simplifying strategy and multi-divisional measurement. Newell might be capable of exercising the management power over Rubbermaid due to the firm size that Rubbermaid has. It is also difficult for Newell to deal with the “Rubbermaid” culture.

Acquisition Analysis:

- Shelf space: due to the high production costs and their inability of lowering price to their major retail customers, Rubbermaid has difficulty of enhancing the number of their shelf spaces. In this case, the buyers have to cover the high production costs that Rubbermaid has. Therefore, retailers are more willing to give shelf spaces to other companies instead of Rubbermaid.

- Different Strategies: Newell and Rubbermaid have different strategies. Newell is mainly focusing on providing satisfied customers service and building up good relationships with their major retailers; on the other hand, Rubbermaid has terrible relationships with their retailers due to failure of achieving economy of scale. It would definitely influence the business if Newell does acquire Rubbermaid because shelf space matters.

- Sales Volumes: Newell cannot sell as much as before after acquiring Rubbermaid due to the scarce number of shelf spaces.

- Profitability: Rubbermaid incurred 18% costs in the past. It is also hard for Rubbermaid to lower their production and administrative cost. The administrative costs would be much higher for Newell than before after the acquisition.

The Usage of Water

The soft drink giant Pepsi has been forced to make an embarrassing admission: Its bestselling Aquafina bottled water is nothing more than tap water. From the tap, you can pour over 6.4 gallons for a penny. That makes the bottled stuff about 7,000 times more expensive. One of the things that we’re finding as we’re talking to people about this issue on the street is that they don’t know where the water is coming from. Environmental degradation in the form of depletion of the local ground water table due to the utilization of natural water resources by the company poses a serious threat to many communities. A scientific study requested by the court found that while the plant had “aggravated the water scarcity situation,” the “most significant factor” was a lack of rainfall. Critics respond that Coke shouldn’t be locating bottling plants in drought-stricken areas.

The Pepsi company is also the target of community campaigns across India accusing the company of creating severe water shortages and pollution around its bottling plants. A number of studies, including those by the government of India, have confirmed the growing water shortages and pollution of groundwater and soil by the Pepsi company. Pepsi’s operations in India have come under intense scrutiny as many communities are experiencing severe water shortages as well as contaminated groundwater and soil that some assert are a result of Coca-Cola’s bottling operations.

Last But Not Least:

Packaging used in Coca-Cola’s products has a significant environmental impact.

Environmental Scandals Of Pepsi

The Usage of Pesticide

PepsiCo holds almost the half market share of soft drink in the world. Pepsico carbonated drinks in India contain dangerously high levels of pesticides CSE tested 57 samples of PepsiCo carbonated products from 25 different bottling plants across 12 states and found pesticide residues in all samples. CSE found that the Indian produced Pepsi’s soft drink products had 36 times the level of pesticide residues permitted under European Union regulations; Coca Cola’s 30 times.

Lindane – a confirmed carcinogen – sometimes as high as 140 times those allowed by EU and BIS standards

* Chlorpyrifos – a neurotoxin – sometimes as high as 200 times those allowed by EU and BIS standards

* Heptachlor – which is banned in India and also has not been used in the US since 1988 – was found in 71 per cent of the samples, at levels 4 times higher than the proposed BIS standards.

* Malathion – a pesticide that the US EPA recommends that workers wait at least 12 hours before entering the area of application – were found in 38.6% of the samples tested.

PepsiCo angrily denied allegations that their products manufactured in India contained toxin levels far above the norms permitted in the developed world. The director of PepsiCo used Pepsi’s brand name to draw attention to her campaign against pesticides.

The 2012 Mercedes CLS 63 AMG will be unveiled very soon. I can’t wait to see the new model running on the road. For North America, the 2012 Mercedes-Benz CLS-Class reportedly reprises the current 5.5-liter and high-performance 6.2-liter AMG V8 engines. The redesigned model will feature an aggressive front fascia, LED daytime running lights, a four-tailpipe exhaust system, and AMG wheels. ower will be provided by a twin-turbo 5.5-liter V8 engine with 544 PS (400 kW/ 536 hp) and 800 Nm (590 lb-ft) of torque. It will be connected to a 7-speed Speedshift MCT transmission which should enable the CLS 63 AMG to accelerate from 0-60 mph in less than 4.3 seconds.

Here’s the spied photo

Here’s the video

I am taking the management course this term. We looked at the company called Iridium. Iridium was the firm that innovated the satellite, and Motorola was its primary contractor. I think it’s a pretty interesting topic. I am going to talk about the reason why Iridium failed to perform well in the market, which is quite related to Marketing Strategy.

- Low Customer Satisfaction: Consumers were not satisfied with the size of the Iridium cell phone and thought their phones were heavy and inconvenient to bring around. Customers were also not satisfied due to the blocked access, rampant interference and dropped calls. In order to use Iridium service, customers had to purchase Iridium cell phones, which cost about 3000 dollars. On the other hand, its direct competitor Globalstar, for example, offered the phone for less than 1000 dollars. Service cost per minute for Iridium was $3, which was almost 10 times greater than Globalstar’s.

- Low Market performance: By the end of 1998, Iridium only obtained 3000 subscribers, which is 0.5% of their target amounts 600,000. The market penetration was 2.5% in 1992 and increased to 33% in 2000. Competitors’ subscribers were from 23 million in 1992 to 650 million in 2000.Their competitors were growing much stronger than before.

- Porter’s Generic Strategy: Iridium had high differentiation in their product, however; the company focused on the single segment. Iridium concentrated on the high-income market and tended to target successful business people who travelled a lot. There were risks involved in targeting such single segment. For instance, this group of people might no longer want their service when they change their taste or requirements. Management team should be responsible for this because they should target different segments to diversify the risks.

- High cost structure: Iridium’s operating expenses were extraordinary high. Iridium had system cost of 4.9 billion, which is 33% more than its competitor globalstar. Their debt-equity ratio was quite high and they had never considered lowering the costs as part of the strategy. The management team should have developed a better cost-structure for the firm.

- Wrong forecasting: Iridium overestimated the demand of their service and underestimated cell phone and Internet technology improvement. The firm failed to understand the customers’ needs. To determine if there is really a need for their product and service and obtain the better estimation, their marketing department should spend more time and investments on the marketing research such as focus group interview, survey, and etc.

- Failure of understanding the industry: The rival in the industry is very high. There are a lot of competitors already existing in the market. Cell phone industry, like any technology-based industry, is always changing constantly. The delay in launch did cost them a lot. Iridium had many technical problems and unrealistic launch time in which had to be postponed for more than a month. As a result, it exerted negative impacts on their brand image. The industry and customers are very time sensitive. Iridium was unable to sell their service due to the delay of delivering the phones. Iridium’s bargaining power over their suppliers was low. The service provider was not exclusive to Iridium because they had several other options to sell.

StarCraft 2 Marketing

StarCraft 2 is one of the most popular online competition games these days. You can see people are fascinated with StarCraft while some of them are spending most of their life time playing it. Why is StarCraft so popular???

I wanna open this “Nerd Business Model” they apply for marketing and share with the secret of why the games has been so successful.

First of all, It’s the good product quality. StarCraft is designed by Blizzard, which is the company that has a portfolio of three multi-million dollar intellectual properties:StarCraft, Diablo, WarCraft. Every time Blizzard releases the new games, its high quality ensures its perfectly stability, absolutely perfect user experiences delivering to the customers. Kevin Martens, the head designer at Blizzard, illustrates this point in an interview last year: “Here’s the secret to Blizzard games, and this is a secret that won’t help any of our competitors: endless iteration. We’ll take something, we’ll put it in the game. Maybe we’ll like it when we put it in, maybe we won’t. We’ll leave it in there for a while, we’ll let it percolate. We’ll play it and play it and play it, and then we’ll come back. We might throw it all out, or we’ll throw half of that out and redo it.”

Secondly, Blizzard is focusing on building the long-term relationship with users rather than transactional basis. Blizzard shows fans that they care about making their games best even long after the game’s initial release. The company improve the game quality time by time and customers are more than welcome to provide feedback to the company. Therefore, customers are loyal.

Thirdly, it’s Blizzard’s brand image. Blizzard puts their attention to every single level in artwork and overall presentation of their properties from the game itself, to the box art, their websites, trailer videos, and any other marketing material. Blizzard also stands for the lifestyle. If you play StarCraft, some people might think you are kind of cool and not out-dated.

Harley-Davidson Motorcycles

I think everyone knows about Harley Motorcycles. Harley Motorcycles is one of the world’s most famous motorcycle manufacturers. Harley is well-known for its super-heavyweight bikes. It has successfully captured over half of the world’s heavyweight market. Harley is an archetype of American style. Together with a few other companies such as Disney and Levi, Harley had a unique relationship with American culture.

Harley’s target customers are middle aged and middle class. For the marketing strategy, Harley consider the Harley-Davidson image and the loyalty it engendered among its customers to be its greatest assets. It is not only selling motorcycles but also the Harley Experience to customers. The company is doing their best to ensure the experience matches the image it conveys and the lifestyle it represents. More than half of all sales were to customers who had owned a Harley before, while about 20% were first-time motorcycle buyers.

However, the rivalry in this industry is pretty high. There are lots of competitors in the market such as Honda and BMW, which offer the lower price and higher technology for consumers. Count on Ducati and BMW to do something every few years. For instance, BMW develops a new appearance and makes the technology change for a model every six years. Harley lagged far behind its competitors in the field of technology and design. The cost disadvantage that Harley has compared to its competitors makes even worse off. Harley’s low production volumes relative to Honda and the other Japanese manufacturers imposed significant disadvantages. I think the cost disadvantage is the purchasing components. Unlike BMW, which has the high bargaining power over suppliers due to size of the company, Harley has lower bargaining power because it purely manufactures motorcycles.

How to attract the younger consumers in the market is also a new challenge for Harley. As the baby-boom generation going downturn, Harley should turn their attention to the new and younger generations. As a 22 year old college student, I will definitely choose a Ducati or BMW motorcycle instead of buying a Harley. Harley should put more focus on the design and technology that creates a connection with younger consumers.

The changing world of motorcycle marketing

First Mover Advantage in Marketing

In my mind, honestly, marketing is all about how to sell things to people although I knew it is not. But sales plays a significant role in the market industry. Most consumers are price sensitive. How to sell your products and successfully capture the market share in the industry? Today, I want to write something related to monopoly power, which is First Mover Advantage.

I think the first mover advantage is also a key factor for the company because it enables the firm to create entry of barrier to its competitors and be able to capture the market shares in the industry. Whoever has the first mover advantage would be most likely to control those scare sources and create switching costs to customers. I am obsessed with Wal-Mart research these days. I would use Wal-Mart as an example to write about the first mover advantage.

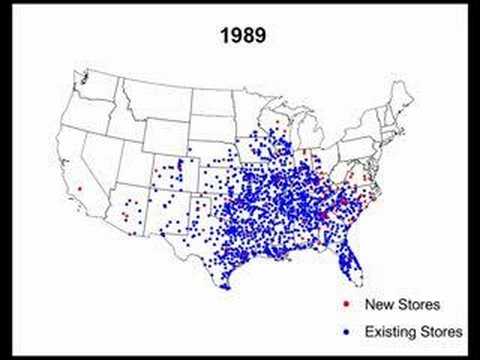

Locating stores in isolated rural areas and small towns in which everyone else is ignoring is the first mover advantage for Wal-Mart. Instead of competing with other stores in urban areas, Wal-Mart locates stores in isolated rural areas and small towns. The company could reduce the competitions and have more bargaining power over buyers. The numbers of Wal-Mart stores are increasing dramatically. Wal-Mart does greater job than its competitors. Wal-Mart could capture the major market shares in rural areas and create the barrier of entry to its competitors.

Wal-Mart

This summer, I went into the Wal-Mart store in China. I was so curious why Wal-Mart can be so successful even in China because there are lots of competitors in this industry before Wal-Mart entered the Chinese market. I did some research online and figured out it’s all about competitive advantage.

Wal-Mart’s main competitive advantages are their low costs system and high product availabilities. By providing large varieties of merchandise to customers with discount price, Wal-Mart has been successful over the last century. The reason why it has been so successful is that Wal-Mart offers lower gross margin products compared to department stores and able to cut down their costs compared to other discount stores. Wal-Mart lowers its gross margin by 10-15% compared to typical department stores. This strategy allows Wal-Mart to cut down their service and other expenses without losing customers. Based on this concept of discounting store, Wal-Mart entered this industry, where sales volume steadily increased over the last few decades.

Here’s the link about the diffusion of Wal-Mart and economies of Density.