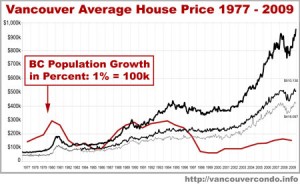

With the average Vancouverite’s income being $44,000, it is becoming increasingly difficult for consumers to secure a single-detached house, considering the substantial and continuous rise in housing prices, attributed mainly to the influx of Mainland China buyers over the past few years, as indicated in Figure 1 (Gold). The status of the many sophisticated Vancouver homes, such as the ones in Shaughnessy, are appealing to the affluent Chinese families that typically have the father working in China while the mother creates a base of education for the children in Vancouver (Reuters).

Seemingly, without family inheritance, it would be near impossible for the average college-educated Millennial to ever own such a property. Therefore, youths should begin to reconsider their definition of a “home” and seek investment in apartments, condos, or townhouses. Alternatively, youths could seek employment outside of British Columbia or Canada. However, it also leads to question if the Vancouver housing market bubble will ever burst, and if so, what will have caused it and what will the consequences be? Will the main culprit be the problem of loans consumers owe banks for house mortgage/down payment? Perhaps this is a case where government intervention to set new regulations may be helpful to even out the playing field in this Asian housing monopoly.

Works Cited

Gold, Kerry. “For Vancouver, Housing And Income Don’t Add Up.” The Globe and Mail. Phillip

Crawley, 7 June 2013. Web. 13 Sept. 2014. <http://www.theglobeandmail.com/

life/home-and-garden/real-estate/for-vancouver-housing-and-income-dont-add-

up/article12436288/>.

“House Prices and Population Growth.” Vancouver Condo Info. n.p., n.d. Web. 15Sept. 2014.

< http://vancouvercondo.info/2010/01/house-prices-vs-population-growth.html>.

Reuters, Julie Gordon. “Foreign Buyers Are Fueling A Seismic Spike In Vancouver’s Luxury

Housing Market, Realtors Say.” Financial Post. Postmedia Network, Inc., 11 Sept. 2014.

Web. 14 Sept. 2014. <http://business.financialpost.com/2014/09/11/china-buyers-

vancouver-housing/>.