The conception of developing a well-rounded strategy will lead the company to successful growth is false. The truth is, when the strategy doesn’t connect with a company’s purpose, it only achieves operational efficiency. The company may sustain a huge dominance over a market in the short-run due to its efficient approach toward its demand; however, in the long-run will face rivalry from business who tells the consumer the WHY they should purchase their product. In this 4-page HBR article, the author touches on several important points on why connecting strategy with purpose is crucial to a company’s success. Additionally, it also includes several examples on how company loses their competitive advantage when failing to integrate strategy and purpose.

One interesting example that the article outlined is that how Nokia fail to convey its purpose when the company is being very efficient in executing its strategy. In 2006 alone, Nokia introduced 39 new mobile-device models, acquiring huge market shares worldwide. However, much of its models are regarded by the consumer as different in styles and essentially the same function: nothing is new. Few years after, when Steve Jobs introduces iPhone with the primary purpose of “connecting people” by means of creating a mini-laptop inside your pocket, Nokia has lost the battle. Another few years after, Nokia was acquired by Microsoft.

Developing strategies and pushing forward initiatives should always not be the first step. Instead, the company must convey its purpose to their employee at first hand. In my opinion, large corporation often might fail to convey its purpose to their employee. Namely, the employee might lose track of the reason why they want to work for the company as well as what the company’s purpose is. Since the organizational structure is often too large to manage, employee’s conception of the company’s purpose may tie directly to simply market shares and profit. Such is evidenced by Uber, who over the past year was involved with many different scandals due to poor management.

The golden circle is something I learnt from a business Tedtalk made by Simon Sinek, entitled “start with why”. The golden circle begins from the center – why, how, what – and maps out why some organizations like Apple and Amazon are different from their competitor. In comparison, most people goes from outside (the clearest thing) into center (the fuzziest thing). An employee may know the tactics, the value proposition, but very often they don’t know what the company’s purpose. And this is precisely why I chose this blog: it teaches me what the best company do – think, act, communicate in the exact same way.

Word Counts: 430 words

Reference

Mesnard, L. C. (2017, November 07). The Best Companies Know How to Balance Strategy and Purpose. Retrieved November 12, 2017, from https://hbr.org/2017/11/the-best-companies-know-how-to-balance-strategy-and-purpose

Figure 1.1. Statistics of Amazon’s Revenue and Net Income from 1997 to 2015.

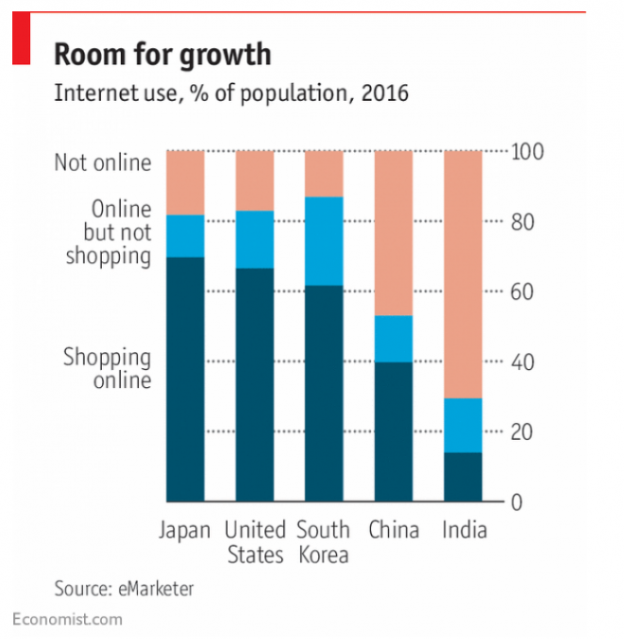

Figure 1.1. Statistics of Amazon’s Revenue and Net Income from 1997 to 2015. Figure 1.2. Room for internet uses growth 2016.

Figure 1.2. Room for internet uses growth 2016.