At my second week of trade I have two transactions made. A Short of 10 units of wheat and a Buy of 5 units of soybean. Both with actual loses of -0.06% and -1.72% respectively, Whit an overall loss of returns of -5.99%

My bought of soybean is in response to the forecast based on the short and long trade history of the grain, although daily prices are in decrease, there’s an increasingly trend at a week an monthly level.

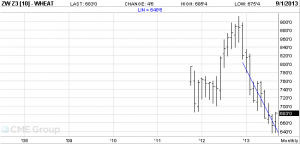

In the case of wheat, despite of the increase in the last week prices, which are pushing up the week and monthly tendencies, this are still in decrease.

Regard energies, diesel prices as a wholesale level was in negative changes during all august but now are in increasingly positive changes in prices. Falls in the total U.S. diesel supplies and central’s bank announcements are contributed to these changes. However, these are not enough arguments to believe in a long trend tendency, which applies to grains which are followers of energy trends.

This next week of trade will be focused on explore the markets news and history than the historical trends in prices.