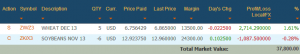

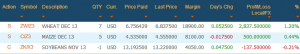

Last Friday, I made an awful decision which made me depressed for a whole week. The decision was SHORT MORE SOYBEAN, which cost me more than $10000 in a week and sent me to the bottom five of the trading game at the final round. Soybean really broke my heart. Suffering from anger and pain, I made another decision today: Kiss Soybean Goodbye!

My relationship with soybean was a long story. I shorted soybean from the first day of this trading game and since then he had never disappointed me. Unlike Corn and Wheat, which were always naughtily jumping up and down, and abandoned me during hard times, Soybean had always been so kind and loyal to me all the time. I shorted to open at the price of $13.19. From mid-September to last week, the price had kept dropping to $12.65 on Oct.15. So I decided that soybean could be the one to trust and the price would keep dropping forever. Thus, when the price of soybean was going up a bit last Friday, I shorted a huge amount of soybeans, hoping that he would bring me a fortune at the final round and we could have a happy ending.

Well, things never turn out the way you want and tragedy is always more impressive. Soybean future price jumped from $12.81 (when I shorted) to $13.09 within a week! Now it’s time to say goodbye and learn from the pain.

In the future market aspect, there are two reasons for the increasing price of soybean. Firstly, since the expired date of Soybean November contract is getting closer, speculators with a short position were currently covering soybean to offset, which pushed the price up. This can be proved by the volume data. In contrast to previous weeks, when volumes fluctuated a lot, the volume has become constantly larger since last week, around 120000. As more and more speculators covered to offset, future price will increase until the profit of offsetting equals zero.

The second reason is that spot price drives future price up. According to LOP, at the expired date, future price will equal cash price. But the basis (f-p) of soybeans has always been negative and the cash price is increasing recently, which together push the future price up. These two reasons combined have led to a dramatic jump of soybean price this week.

In the supply and demand aspect, recent news has a complicated impact on the future price: Demand boosted the market while supply descends the price. According to a USDA report early this week, the soybean export demand is increased compared to last year. During this active harvest and delivery season, foreign buyers, such as China and Russia, keep importing huge amount of soybeans since last week, which boost the spot market and pull up the future. On the supply side, dry weather ensures a good harvest weekend, which will lead to a rapid harvest progression and better- than-expected yields. As a result, the future price was first increased and then decreased.

Wow! I have been talking so much about soybean. It’s my hate and love. Burned my fortune in future market but produced my favorite soy sauce and tofu. What else can I say.

Trading game is coming to an end. The end of the game, the start of my real future!

Ciao!