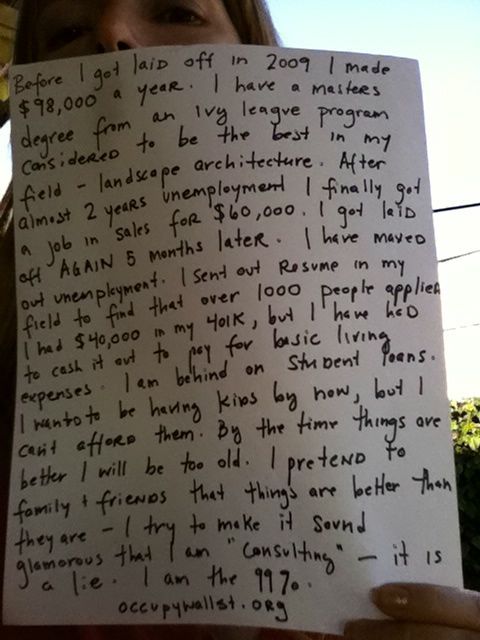

I recently came across a very interesting post by fellow Sauder blogger Kashmir on the mystery of increasing tuition fees. As poor stduents who can barely scrape enough together to make ends meet, undergraduates definitely do not like to see continuous increases in tuition on a yearly basis. However, this is precisely what is happening all over the nation. As Kash mentioned in her post, average undergrad tuition fees increased from $4, 942 to $5, 138 in 2011. Commerce students face the biggest increases, even here at UBC.

What explains this general upward trend in tuition fees is the ever-increasing demand for higher education. Faced with high demand from both domestic and international students, universities have the ability to admit and reject according to their own standards. This increased selectivity can be seen in the higher admission averages each year. However, such a trend also provides universities with massive supplier power. After all, alternatives to a university education seem less and less favourable in the consumer (student’s) eyes.

Kash mentioned a very interesting idea on universities offering a “differentiated product”, thus providing them with more supplier power. I believe this definitely has to do with the ability of some prestigious universities to conveniently “bump up” their tuition, because they are able to offer unique eductional methods and good learning fascilities that students will not be able to obtain elsewhere. Moreover, parents and students are also significantly affected by each university’s “brand image”. The university of Toronto, for example, is able to charge significantly higher tuition than its counterparts in the Maritimes provinces because of its reputation as “Canada’s best university.”

Education, unfornately, is an inelastic good. With rising trend in demand, bargaining power of educational institutions will continue to go up. Students as individual consumers have little they can say about the increase in prices, unless they opt to drop out altogether and face lower wages. The only way to solve this problem is to set a cap on how much universities can charge students for an undergraduate degree, thus resulting in more students with the ability to live economically sufficient lives.

Photo credit: http://www.theglobalcity.org/wp3/?page_id=288

Credit:

https://blogs.ubc.ca/kashkaur99/2011/10/14/the-mystery-of-increasing-tuition-fees-is-it-supplier-power/#comment-7 (Kashmir’s post)

http://www.statcan.gc.ca/daily-quotidien/100916/dq100916a-eng.htm (Statistics Canada’s information about recent tuition fees)