Having only the notion that the European debt crisis was “bad”, I never quite understood the specific mechanisms which gave rise to the problem. After doing some research on this issue, however, I realize that it’s not as complicated as it’s made out to be. It all has to do with the faulty financial decisions of each country that got tangled up into an international frenzy of lending and borrowing.

It all started when…

Members of the EU decided to use a universal currency: the euro. This allowed countries such as Greece, Portugal, Italy, Ireland, and Spain to borrow money at the same interest rates as Germany. As American writer Michael Lewis put it: “The rest of Europe, in effect, used Germany’s credit rating to indulge its material desires. They borrowed as cheaply as Germans could to buy stuff they couldn’t afford.”

To exacerbate the problem…

Inflation rates for each country was different; namely, inflation is higher for countries like Greece and Italy than for Germany. Moreover, the inflation rate for these countries were higher than the interest rate charged on their loans.

Countries started borrowing excessively…

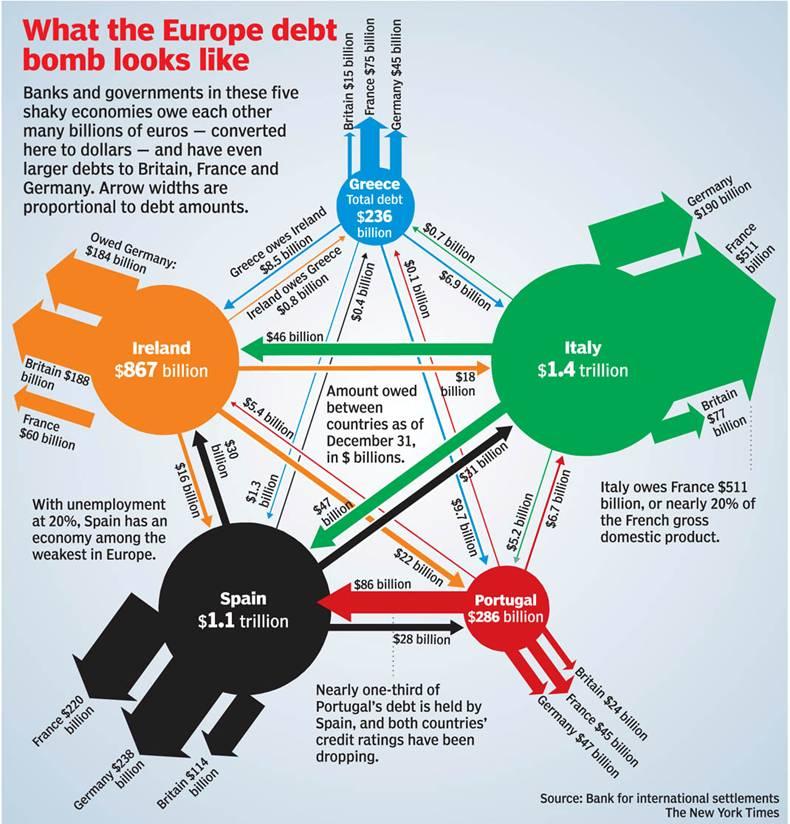

Because it was such a good deal to take loans, both the citizens and governnments of these countries started to accumulate enormous amounts of debt. To get an idea of how much, Greece currently owes 160% of its GDP. Spain, on the other hand, has real estate debt that amounts to 50% of its GDP..

Now the European Central Bank has to step in…

Even though Greece is rated 126th with debt (the least likely country to pay off their loans) ECB will continue to buy its government bonds and give out loans. Countries like Germany end up giving money to indebted governments so that the money can somehow end up in banks which will be able to repay the loans. The whole process is convulated and bordering on bizarre.

So why doesn’t the other European countries just switch back to their old currencies?

Switching would at a glance seem to solve the problem altogether. Countries like Germany can just reissue large amounts of its own currency to pay off the banks right? In reality, however, switching would produce a large burden on citizens. They will be forced to convert their current euros to other valuables, which will lead to a full-on bank-run.

Thus…the only solution the EU has at present, is to continue using the ECB to supply countries like Greece and Spain with the money they need.

Photo Credits:

1) http://www.thedigeratilife.com/blog/european-sovereign-debt-crisis-investments/

2) http://www.tradingpetroleum.com/currency_exchange_euros.htm

References:

http://www.rediff.com/business/slide-show/slide-show-1-all-about-european-debt-crisis-in-simple-terms/20110819.htm

http://www.cbc.ca/news/world/story/2011/09/26/f-voices-euro-debt-crisis.html

http://news.yahoo.com/greece-europe-struggle-contain-debt-crisis-061201682.html