http://news.ubc.ca/2014/06/30/upward-arc/

http://www.sauder.ubc.ca/Global_Reach/ARC_Initiative

http://b.vimeocdn.com/ps/365/442/3654422_300.jpg

http://i.ytimg.com/vi/354LEeAuYFA/0.jpg

I believe that initiativ es such as the Arc can be best summarized by the proverb: “Give a man a fish and he will eat for a day; teach him to fish and he will eat for a lifetime.” Keeping this in mind, it is imperative to acknowledge that social enterprises differ greatly from many of the social causes of the United Nations. Where

es such as the Arc can be best summarized by the proverb: “Give a man a fish and he will eat for a day; teach him to fish and he will eat for a lifetime.” Keeping this in mind, it is imperative to acknowledge that social enterprises differ greatly from many of the social causes of the United Nations. Where

many social ventures do not address the underlying factors of an issue, the Arc provides tools that enable entrepreneurs in developing countries to achieve sustainable growth in the hopes of creating a positive ripple effect in the area. In this regard, I believe that the Arc Initiative arguably supersedes many of the charitable efforts of the United Nations, creating a necessity for it even if the UN was fully funded.

The legacy that Arc has left behind in various communities is a testament to Jeff Kroeker’s goal of “building capacity, building relationships and ultimately, building a better future.” Having just learnt about the Arc and the lasting impacts that it has on communities in Africa and South America has opened my eyes to the array of opportunities available at Sauder. Programs such as this are  key components of the global commerce community. I would like to get involved with a social enterprise one day; hopefully using my knowledge to contribute to the business communities in developing nations, while at the same time gaining valuable lessons from the experience.

key components of the global commerce community. I would like to get involved with a social enterprise one day; hopefully using my knowledge to contribute to the business communities in developing nations, while at the same time gaining valuable lessons from the experience.

The above article discusses what it means to be an entrepreneur and the implications for our economy. It elaborates on two different types of entrepreneurs: “replicative” entrepreneurs are people who set up small businesses similar to other small businesses in the industry whereas “innovative” entrepreneurs are disruptive innovators who reinvent the industry. The article notes that the latter type of entrepreneurs are vital for the growth and health of an economy.

The above article discusses what it means to be an entrepreneur and the implications for our economy. It elaborates on two different types of entrepreneurs: “replicative” entrepreneurs are people who set up small businesses similar to other small businesses in the industry whereas “innovative” entrepreneurs are disruptive innovators who reinvent the industry. The article notes that the latter type of entrepreneurs are vital for the growth and health of an economy.

t lost $2.5 billion between his positions in IBM and Coca-Cola. This article discusses how

t lost $2.5 billion between his positions in IBM and Coca-Cola. This article discusses how companies with strong fundamentals. Keeping this in mind I think it is highly unlikely that Buffett will liquidate these positions or change his investment strategies.

companies with strong fundamentals. Keeping this in mind I think it is highly unlikely that Buffett will liquidate these positions or change his investment strategies.

article above briefly outlines some of the questions that are asked to candidates during their interviews for employment at Goldman Sachs. The firm’s global head of recruiting, Michael Desmarais says that a common interview question would be to evaluate a company’s market valuation or to provide a stock pitch. In addition to this, the company blog indicates that it attempts to use the interview process to judge an individual’s creativity and problem-solving abilities. They do this by asking prospective employees to describe a procedure that can be used to figure out how many manhole covers there are in New York City, or similar thought provoking questions.

article above briefly outlines some of the questions that are asked to candidates during their interviews for employment at Goldman Sachs. The firm’s global head of recruiting, Michael Desmarais says that a common interview question would be to evaluate a company’s market valuation or to provide a stock pitch. In addition to this, the company blog indicates that it attempts to use the interview process to judge an individual’s creativity and problem-solving abilities. They do this by asking prospective employees to describe a procedure that can be used to figure out how many manhole covers there are in New York City, or similar thought provoking questions. qualities typically associated with entrepreneurship, but utilize them within a large company. Employing the skills of such individuals is imperative to the growth and success of any firm and I believe that more companies will begin to ask similar brain teasing questions during interviews in order to help them find ideal employees.

qualities typically associated with entrepreneurship, but utilize them within a large company. Employing the skills of such individuals is imperative to the growth and success of any firm and I believe that more companies will begin to ask similar brain teasing questions during interviews in order to help them find ideal employees.

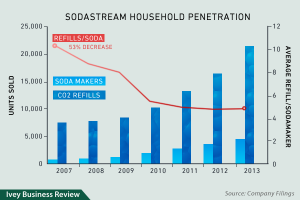

vides interesting insight into Sodastream, and focuses on several key talking points of recent COMM 101 lectures. Sodastream is a company that allows customers to make their own pop or carbonated beverages according to their own preferences from the comfort of their own home. Their primary value proposition is that they offer a healthier, cheaper alternative to traditional cola by offering individual customizability and a large assortment of flavor selection. Consumers can control what goes into the soda that they are drinking and this is Sodastream’s Point of Difference. They have developed a product that has less calories, carbs, sugar, sodium, and caffeine, and is also $0.22 cheaper/litre of soda compared to generic brands.

vides interesting insight into Sodastream, and focuses on several key talking points of recent COMM 101 lectures. Sodastream is a company that allows customers to make their own pop or carbonated beverages according to their own preferences from the comfort of their own home. Their primary value proposition is that they offer a healthier, cheaper alternative to traditional cola by offering individual customizability and a large assortment of flavor selection. Consumers can control what goes into the soda that they are drinking and this is Sodastream’s Point of Difference. They have developed a product that has less calories, carbs, sugar, sodium, and caffeine, and is also $0.22 cheaper/litre of soda compared to generic brands. ways to regain steadily increasing profits. The challenges that Sodastream are facing proves that the business landscape is constantly

ways to regain steadily increasing profits. The challenges that Sodastream are facing proves that the business landscape is constantly

rice.

rice.