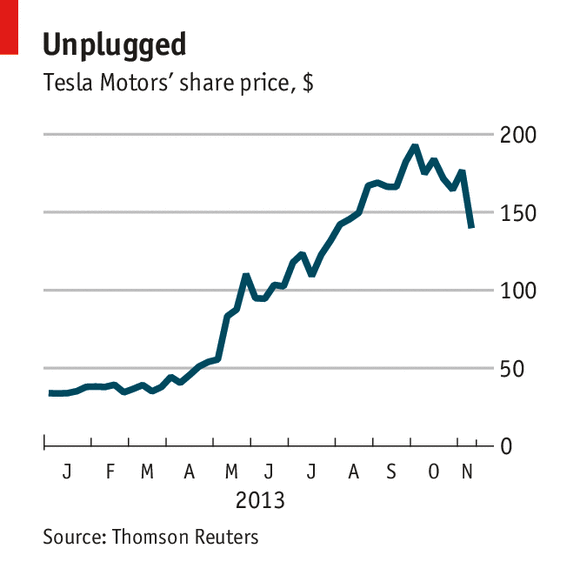

Tesla Motors share price growth has changed greatly due to drivers reporting 3 fires in six weeks in their Model S sedan. This made industry analysts and investors increasingly skeptical about the firm’s prospects and stock which trades on the NASDAQ stock market. When the first report was made public it put a sudden stop to Tesla’s rising share price which peaked in late September at $194.50 a share, up from around $35 at the start of the year.

This week the slide became so steep that it caused NASDAQ to trigger its “circuit-breaker” at one point, to slow down the plummeting share price. On November 7th the share price fell to $139.77.

Investors cannot figure out the value of Tesla Motors because it is a firm that is just starting to increase its production and is in a surprisingly slowly developing industry. Due to its increase in demand, there has been a massive shortage in Lithium-Ion car battery packs. Current production is 5,500 cars a month and that number should increase when the Model X crossover comes out next year.

I believe that investors have the right to be cautious when it comes to Tesla Motors because Lithium Ion batteries became associated with fire and loss of revenue during the Boeing Dreamliner problem.

Work Cited:

Elliott, Mike. “Tesla Motors: Driven to Distraction.” The Economist. The Economist Newspaper, 8 Nov. 2013. Web. 18 Nov. 2013.