As most people are aware, the exponential growth of technology is once again flexing its muscles as TV and cable packages are slowly becoming less and less desirable. Aarun Sandhu recently posted a blog which analyzes a strategic move made by EastLink TV, a smaller cable provider, to try and compete with the larger companies. I feel as good as this strategy looks at first glance; it is rather obsolete in the sense that most middle to older aged customers have established a preferred provider. It would most likely be seen as too much of a hassle to make the big switch from what they know and trust is reliable to take a chance on the small, up and comer company. As for the younger people, the source of entertainment seems to be their computers and the internet where they can stream their favourite shows on demand and save costs while doing so. New cell phone companies have also made moves similar to this and they have proven unsuccessful in the long run. Despite the fact that EastLink TV is doing their best to appeal to the customer and their needs, I am afraid that this move is about 10 years too late.

Comment on a class member blog (1)

Being that cars are of fairly large interest to me, I was intrigued when I saw Paul Freiwirth’s Blog on Tesla and their Direct Business model. I have to agree with the comments made by both Paul, and the VP of Business development at Tesla. As a company that strives to deliver on their Points of Difference, it would be a major blow to Tesla if they were all of a sudden forced to conform to the accepted practices of the rest of their competitors. They are a very unique car company which is fairly new to the market in comparison to others, therefore why should they relinquish any sort of control of their product or marketing to someone other than themselves? Like Paul has mentioned, it is evident that companies such as Dell have been able to thrive in their respective industries while having no negative effect on the competitive environment by operating on a more direct business model which proves that there should be no reason why Tesla cannot do the exact same thing. If they were receiving some sort of unfair advantage from operating on a model like this then that would be a different story.

”if it isn’t broke, don’t fix it”

The Layers of Accounting

I have enjoyed my time in Comm 101 thus far. The lectures are structured so that they are always engaging. Because of the nature of the class, and given the fact that we are operating on a fairly limited schedule, concepts may appear difficult. I wanted to find a way to help reinforce the difficult things learned in class like certain accounting concepts. Accounting Onion is a blog which has served as a huge benefit. Posting on a weekly basis, this blog allows me to further my understanding and knowledge of concepts that have been touched on during the lecture. The Blog does a good job of applying concepts such as financial reporting, revenues, and accounting standards and applying them to real life scenarios. This allows a prospective accounting student such as me the ability to relate what is being taught to us through issues that are prominent within the world we live in. I feel that next to real life experience, this is one of the best ways to fully understand a concept Being that the blog is maintained by a proven industry professional (Thomas I. Selling PhD, CPA), it is safe to say that the information is both credible and relevant.

Possible Imitators ?

There is a fine line drawn in the sand right now. One side of it is impersonation of a billion dollar company which damages their reputation. On the other, is completely legal business practice for one’s own benefit. After reading the story of Starbucks vs Charbucks I could not help but think about the recent battle between Trader Joes (a large grocery chain in the united states) and Pirate Joes (a specialty grocery store open in Vancouver).http://www.cbc.ca/news/canada/british-columbia/trader-joe-s-loses-fight-with-vancouver-s-pirate-joe-s-1.1912400

There is a fine line drawn in the sand right now. One side of it is impersonation of a billion dollar company which damages their reputation. On the other, is completely legal business practice for one’s own benefit. After reading the story of Starbucks vs Charbucks I could not help but think about the recent battle between Trader Joes (a large grocery chain in the united states) and Pirate Joes (a specialty grocery store open in Vancouver).http://www.cbc.ca/news/canada/british-columbia/trader-joe-s-loses-fight-with-vancouver-s-pirate-joe-s-1.1912400

My initial reaction to this was something along the lines of these large companies are doing nothing but bullying the self-proclaimed “little guy”. How could one little store seriously affect the profits of a large corporation such as Starbucks or Trader Joes? The Simple answer is that it cannot, however, soon enough another store will pop up, and then another one, and before you know it there is a Pirate Joes or Charbucks products in each city or province. This is why these large companies are heavily pursuing law suits and I fully agree with it. The recent over rulings in court are putting these large companies at huge risk as it now sets a precedent. The line has to be drawn in the sand.

http://www.theglobeandmail.com/report-on-business/international-business/us-business/starbucks-loses-bid-to-stop-charbucks-from-selling-coffee/article15464560/

Enough is enough.

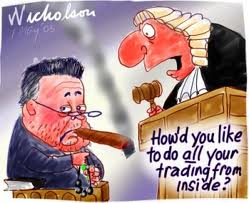

It seems as if people in authoritative positions within the different governing bodies such as the SEC are as committed as ever on cracking down on insider trading. For those who are not aware, insider trading simply means that someone has access to information about a public company which is not made public, and then trades stocks or bonds in reaction to this(usually an employee of the company.) Using this private information to benefit is seen as an unfair advantage. Recently an employee of Level Global’s consumer sector, Mark Megalli pled guilty to insider trading which helped the company’s hedge fund avoid losses and receive an undisclosed amount of money within 2.5 and 7 million dollars. (http://online.wsj.com/news/articles/SB10001424052702303289904579198621248299610)

One commission is taking a stance on this issue. I feel that Sebi (Securities Exchange Board of India) has really come up with an innovative idea on how to better prevent similar issues from happening. A proposal has been put forward which basically states that notification 3 months ahead of time must be given my insiders and promoters if they are wanting to trade. Although the practicality of all of this may come into question, I firmly believe that a similar implementation might better prevent illegal insider trading.

Everyone loves a doughnut…or two

It is always promising to see students who were once sitting in the same seat as me, receiving the same life changing knowledge, from the same business school that I am currently attending, using the information they learned to conduct business in a dynamic way. When people think about doughnuts what initially comes to mind? The typical answers tend to include Tim Horton’s or Krispy Kreme. One member of Sauder’s 2010 graduating MBA class decided to put his entrepreneurial skills to the test, to follow his dream of operating and owning a doughnut shop http://cartems.com/the-cartems-story/ . You can find Jordan Cash and Cartems Donuterie on 534 W Pender Street in Vancouver. Striving to set himself apart from the generic doughnut establishment, Jordan has focused on points of difference such as local ingredients and healthy alternatives. Healthy alternatives?

Rarely are those words associated with a doughnut but Cartems offers a vegan, gluten free selection in addition to the more traditional (less healthy) style. Setting realistic goals in terms of growth is something to admire. Currently, Cartems Donuterie is working on elaborating on their current business model and adding a delivery service which I feel exposes them to a whole new market (weddings, birthday parties, large events.)

http://www.bcbusiness.ca/careers/mba-grads-pursuing-the-entrepreneurial-path

oink oink, anyone craving bacon ?

Businesses come in all shapes, sizes and…flavours. I always have and always will admire people who have found a way to harness their true passions in life and turn them into a successful and thriving business. The most recent proposition to catch my eye is that of Chef Mark and Chef Krissy. (For you vegetarians out there, I am sorry but this isn’t for you.) Pig on The Street is a Bacon-Oriented food truck which has recently been featured on Eat Street, a popular show on the Food Network. (https://www.youtube.com/watch?v=8z2XsTjZ-iY). Start-up costs were fairly simple as their food truck is a converted camper van which the couple had previously owned. Advertisement also comes a little cost as there is an exponentially growing love for the industry through food bloggers and popular local personalities with twitter accounts. Setting themselves apart from a restaurant style business plan, rent costs were virtually non-existent as the only fixed cost associated with that would be their permit from the City of Vancouver. However, what makes this proposition even more impressive is the sustainability associated with Pig on The Street as all of their products (bacon, cheese, organics) come from British Columbia. Providing the citizens of Vancouver with a unique product, in densely populated areas, the sky is the limit for Mark and Krissy.

http://www.pigonthestreet.com/

Landing Fees

Face to face contact is crucial even in the modern business world of the 21st century. A popular way to fulfill this requirement is through air travel. As of late this has been made difficult as Landing Fees have increased exponentially. The consumer bares the brunt the increase because it is very easy for airlines to include such mentioned fees into the ticket that they sell to the unassuming customer. Most recently, two of the busiest airports in the world, London Heathrow and Gatwick, have had plans approved to raise landing fees over the next 5 years. This is not only detrimental to residents within Europe, but residents of other continents too as a majority of flights to European countries go through those two airports. Why should ticket prices be affected as a result of these increases? As a consumer and frequent flyer, I look at this and feel that I am not only paying for the service, but the “rent and utilities” of the airlines that offer these services. The frightening thing is there is nothing that can be done. After all time is money. How else are we supposed to get from country to country so quickly?

Face to face contact is crucial even in the modern business world of the 21st century. A popular way to fulfill this requirement is through air travel. As of late this has been made difficult as Landing Fees have increased exponentially. The consumer bares the brunt the increase because it is very easy for airlines to include such mentioned fees into the ticket that they sell to the unassuming customer. Most recently, two of the busiest airports in the world, London Heathrow and Gatwick, have had plans approved to raise landing fees over the next 5 years. This is not only detrimental to residents within Europe, but residents of other continents too as a majority of flights to European countries go through those two airports. Why should ticket prices be affected as a result of these increases? As a consumer and frequent flyer, I look at this and feel that I am not only paying for the service, but the “rent and utilities” of the airlines that offer these services. The frightening thing is there is nothing that can be done. After all time is money. How else are we supposed to get from country to country so quickly?

The Unlikely Contributor.

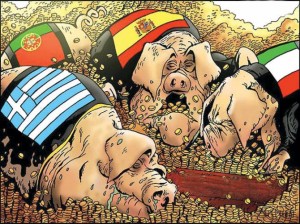

It is no surprise that debt within Europe has reached an all time high. At first glance, we see the obvious and expected causes of this monumental deficit. Real-estate bubbles, high risk lending, and disturbed international trade balance … the list goes on. What very few individuals are unaware of, is the “unlikely contributor”. Professional Football (soccer) teams are estimated to have a combined debt of around three and a half billion dollars, and that’s just within England. The Spanish league is not too far behind with a total of eight hundred seventy five million and their situation is outlined in detail herehttp://www.theguardian.com/football/2013/mar/21/eu-debt-spain-football-clubs . Being a football fanatic, this is something that doesn’t come to mind right away, however the fact that these clubs are able to borrow so much money is quite alarming. Government officials are starting to raise the red flags in this situation. Public entities like hospitals and other companies, along with taxes such as the VAT are being raised in an effort to produce short term income success. With that fact right there, another ethical question is posed to the citizens and governing bodies within Europe. When does financial well being outweigh the love and passion for the game so many grow up on ?

Could a lack of ethics lead to the premature end of natural resources ?

Unbeknownst to a majority of British Columbians, a corporation most citizens are familiar with is taking advantage of a law created one hundred years ago. Nestle, a water bottle company is getting one of their main resources needed for production, free. They have been and continue to take water from different areas within BC at zero cost. “How is this possible?” a question which comes to mind immediately. It seems like nothing is free these days. In all seriousness, it’s no secret resources are scarce, therefore, why is there no limit or price put in place to regulate the usage. Provinces like Ontario have since been charging Nestle for the water they extract. The argument could be made that what Nestle is doing is unethical in the sense that they are exploiting laws passed in 1909 which do not protect the water in BC. From Nestlé’s point of view, finding loopholes like this allows them to maximize profits, a fundamental in business. As Freeman explained, regulations will eventually be put in place in situations similar to this, thus categorizing Nestle as a “business that is likely to decline”. Will Nestle be able to adapt by finding perhaps more ethical ways to yield the same profits?

Unbeknownst to a majority of British Columbians, a corporation most citizens are familiar with is taking advantage of a law created one hundred years ago. Nestle, a water bottle company is getting one of their main resources needed for production, free. They have been and continue to take water from different areas within BC at zero cost. “How is this possible?” a question which comes to mind immediately. It seems like nothing is free these days. In all seriousness, it’s no secret resources are scarce, therefore, why is there no limit or price put in place to regulate the usage. Provinces like Ontario have since been charging Nestle for the water they extract. The argument could be made that what Nestle is doing is unethical in the sense that they are exploiting laws passed in 1909 which do not protect the water in BC. From Nestlé’s point of view, finding loopholes like this allows them to maximize profits, a fundamental in business. As Freeman explained, regulations will eventually be put in place in situations similar to this, thus categorizing Nestle as a “business that is likely to decline”. Will Nestle be able to adapt by finding perhaps more ethical ways to yield the same profits?

http://www.vancouversun.com/technology/Opinion+water+problems+bigger+than+Nestl%Chttp://www.vancouversun.com/life/Nestl%C3%A9+extraction+groundwater+near+Hope+riles+First+Nations/8817969/story.html3%A9/8822186/story.html