Carbon Tax System in Finland

Quick Facts

Finland was the first country to introduce carbon tax as an instrument for climate change mitigation. The carbon tax was put into effect in January, 1990 in Finland, where they only contributed 0.3% to the worlds CO2 emissions1; the tax was based on the carbon content of the fossil fuels and charged at €1.12 per tonne of CO2 ($1.51 CAD, using today’s exchange rate) when it was first started. The carbon tax was reformed in 1997 and 2011. Now, it’s evolved into a combined tax of carbon and energy tax charging €18.05 per tonne of CO2($32.82 CAD) and €66.2 per tonne of carbon ($89.08 CAD)2. In 2010, Finland’s CO2 emissions was ranked 59th among the countries in the world3. Below is an overall picture of the current effective carbon tax rates among countries (the list is not exhausted but it gives you the significant ones). Finland’s is ranked 15th. To make a comparison with the countries we are more familiar with, Canada and the US are ranked 32th and 33th respectively in the world’s effective carbon tax rates. In 2010, their CO2 emissions were ranked 2nd and 9th in the world 3and there is probably no significant change in these 2 years considering the level of effort each has been putting in.

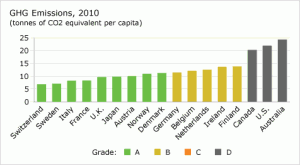

However, in terms of per capita greenhouse gas emissions and energy consumption, Finland was ranked among the highest countries in 2010 which is illustrated in the greenhouse gas emissions “report card”4 below.

Origin & Goals

Let’s now take a step back. How was the carbon tax originated?

More than 20 years ago, climate change already caught the global attention. The first world climate conference was held at February 1978 in Geneva, where climate topics were identified, studies and research on climate change were initiated. Since then, the sustainable development issues have started to influence the policy-making in Finland5. Also, it was foreseeable that the world would need to join in dealing with the climate change. It would allow a competitive advantage to start first even though the costs would be relatively higher due to the lack of experience.

The purpose of the carbon tax is to curb the emissions of greenhouse gases primarily CO2. CO2 can remain in the atmosphere for 100 years; it absorbs heat rays (infrared radiation). With massive amount of CO2, it results in global warming and initiates anomalies in the ecosystem threatening the living beings. The carbon tax is to create an incentive for reducing CO2 emitting human activities, from something small and everyone can do like the use of vehicles, to something big but not unattainable like adopting a cleaner technology in production.

Again, the carbon tax is based on the carbon content in the fossil fuels. The carbon content in every form of fossil fuels is precisely known, so is the amount of CO2 released into the atmosphere when the fuel is burned. This is an important and necessary prerequisite for carbon tax to work because the measurement of the quantity of pollution is based on it. As Dr. Ron Wasik said, “If you can’t measure it, you can’t control it.” Only with the accurate measurement can the efficiency and equity of carbon tax itself be ensured.

Coverage

When the tax was first initiated in Finland in 1990, there were few exemptions for specific fuels and sectors.

- Peat and natural gas had a favorable tax treatment with a special deduction scheme in the sales taxation (the value added tax). Peat as an energy source might be relatively less known. It is an accumulation of partially decayed vegetation which can be burned to generate heat and electricity. Peat is an abundant resource in Finland6. In 2005-2010, the tax on peat was exempted7 because it was considered biofuel different from fossil fuel,even though it emits CO2 during combustion. In fact, peat emits the same amount of CO2 as coal per unit of energy8. This probably works in favor for the energy demanding industries in Finland but not the environment and it should also bring up questions about the effectiveness of the carbon tax implemented in Finland.

- On the other hand, wood industry was exempted from the carbon tax. The wood industry in Finland is an export-oriented industry which enjoys comparative advantage in the world. It makes a logical sense why they allow the exemption for the wood industry; however,again, it raises questions about the effectiveness of the carbon tax.

- In addition, fuels used in industrial production as a raw material or inputs in the manufacturing of goods (i.e. for non-energy purposes) were also exempted8. This is contradictory to the idea of taxing the “upstream” industries2. It does seem like when the carbon tax was introduced in Finland, it was not used in the way as it was truly intended to be.

Finland has remained as an active supporter and implementer of carbon tax since the inception of it. Learning from the past experiences, there were adjustments to the carbon tax rates and coverage over the years. The major reforms took place in 1997 and 2011. In 1997, the rates were largely increased and the carbon tax was added with a tax on the consumption of electricity1. In 2011, the carbon tax was turned into a combination of carbon tax and energy tax7. The tax rates were adjusted accordingly among the carbon component and the energy component and the peat was set to be reintroduced.

Distributional Effects

The carbon tax system is more than putting a levy on the fuels or energy and collecting money from those. In Finland, they have a combination of tax-shifting packages for making the carbon tax revenue-neutral9, by tax reduction such as reducing income taxes, etc. In fact, their earlier policies aiming at reducing income taxes just coincided with their initial climate change initiatives where the carbon tax was introduced. The Finnish government seems to be using the tax cuts for income transfer from the higher income group to the lower income group. For example, in the tax cuts proposed by Finnish government in 2009, the tax cuts would be distributed equally over all income levels, and would also apply to pensioners10. Despite all, some industry representatives still think that carbon tax is just another way to increase government budget revenues.

Conclusion

It’s always not easy for the first timer. Finland as the first timer of carbon tax in the world did put in hard effort in going after a sustainable and better future. It seems to me that due to some political reasons and maybe more of the short term economic considerations, Carbon tax in Finland hasn’t worked as effectively as it potentially can. Without a comprehensive cost and benefit analysis, it’s hard to say what is the most appropriate scheme. However, at the very least, we can see that the energy source and industry that generates the most CO2 are being treated with favors. This is against the motive of climate change mitigation.

1. Economic Instrument in Environmental Policy. (2008, Dec). Economic Instruments – Charges and taxes. Retrieved from http://www.economicinstruments.com/index.php/climate-change/article/119-

2. Carbon Tax Center. (2013, Jan). Pricing carbon efficiently and equitably. Retrieved from http://www.carbontax.org/progress/where-carbon-is-taxed/

3. Rogers, Simon. (2012, June). World carbon emissions: the league table of every country. Retrieved from http://www.guardian.co.uk/environment/datablog/2012/jun/21/world-carbon-emissions-league-table-country

4. The Conference Board of Canada. Greenhouse Gas (GHG) Emissions. Retrieved from http://www.conferenceboard.ca/hcp/details/environment/greenhouse-gas-emissions.aspx

5. Wikepedia. (2012, Oct). World Climate Conference. Retrieved from http://en.wikipedia.org/wiki/World_Climate_Conference

6. Wikipedia. (2013, Feb). Peat. Retrieved from http://en.wikipedia.org/wiki/Peat

7. Ministry of Evironment, Finland. (2012, Feb). Environmentally related energy taxation in Finland(2012). Retrieved from http://www.environment.fi/default.asp?contentid=147208&lan=en

8. Vourc’h, Ann and Jimenez, Miguel . (2000, Jan). Enhancing environmentally sustainable growth in Finland. Retrieved from http://www.oecd.org/greengrowth/economicpoliciestofostergreengrowth/1880843.pdf

9 . Andersen, Mikael Skou. (2010, Mar). Europe’s experience with carbon-energy taxation. Retrieved from http://sapiens.revues.org/1072

10. Jokivuori, Pertti. (2008, Sep). Tax cuts proposed under 2009 budget plan. Retrieved from http://www.eurofound.europa.eu/eiro/2008/08/articles/fi0808029i.htm

“..in terms of per capita greenhouse gas emissions and energy consumption, Finland is ranked among the highest countries in 2010.”

Just goes to show that carbon taxes are ineffectual, Finland proves it.

So why would any country in the world even consider implementing a carbon tax? Because it is simply another way for governments to generate revenues.

This is truly a revealing article. Thanks.

klem

Hi klem,

Thanks for your comment. It is difficult or even I believe it’s impossible to implement a 100% cost-effective carbon pricing scheme due to reasons from politics, technologies.. etc. Despite the imperfections, carbon pricing would be a direct way to tackle the climate change issues. As for whether the carbon tax in Finland is truly revenue neutral, some representatives say they don’t believe so.. It’s a pity that I can’t find any further information regarding why they say / think so.

Hi,I like your graph,which can clearly illustrate greenhouse gas emissions in each country. It is very inspired to point out the measurement of carbon quantity is important.

Thanks Iris. I like the illustration there too. I wonder why there’s no F grade? Glad that they all passed? haha

Thanks for sharing good information about Finland’s carbon tax policy.

As you mentioned, carbon tax hasn’t been very effectiely worked in Finland. But, I think that Finland is very initiative becasuse it is the first country to impose carbon tax. I believe Finland played really important role to motivate other countries to use carbon tax!

P.S. Thanks for a comment on my blog. Denmark imposed energy tax first and then carbon tax on the top of energy tax. So, two taxes are totally different. I hope it answers your question 🙂

Thanks Cindy. I guess it’s similar for Finland, they call the taxation energy taxation and energy tax which consists of an energy component and a CO2 component. I guess I still don’t know how to clearly differentiate the energy component and the CO2 component. =\

Thanks, Roson. That was a enlightening, and critical blog post! If my understanding is correct, the peat is an alternative source of energy that is intended to recycle landfill waste. Has the government imposed measures to favourably exempt the green sources from carbon and energy taxes? Is peat categorized as part of the energy tax? I also didn’t understand the treatment of peat under the current regulation.

Hi Vicki,

Thanks for your comments. I did think whether I was being overly critical, after I finished the post. My answer was yes. However, I ran out of time to make a fairer “analysis”. Thanks to Cindy above, she pointed out what Finland did well indeed, they are the pioneer or carbon tax.

From what I have read, biofuel is exempted which is normal, I haven’t found information about how Finland government deals with other green sources, OR whether there’s any favorable scheme for the green sources or not.

As for peat, it’s a cheap energy source and it emits CO2 as much as coal. It’s exempted in year 2005-2010. Finland is reintroducing the taxation on peat, they call it energy tax. (http://www.environment.fi/default.asp?contentid=147208&lan=en)

I like the quick facts. Could you make the picture bigger next time?

Is there any cost-effective allocation analysis?

Thanks Victor. The picture is what I got from the internet. You may click on it and see it in its “original” resolution. haha. .

Regarding to the cost-effectiveness, I just briefly discussed it in my conclusion that the the peat as an energy source and the wood industry which generate most intensive CO2 emissions are not covered by the tax. Cheers.

Pep will get the cheque book out as City believe Sessegnon could play for them immediately because of his outrageous potential.

The 25-year-old has helped himself to nine goals and six assists this season but his future is up in the air after failing to agree a new deal.