I started this week with lots of hope. I was planning and hoping to make a strong comeback on Thursday as the USDA report was being released. However, something happened. No only my hope went dashed, I am left with a negative balance in my trading account now.

What happened? Accidentally, not according to my will, 23 short corn contracts (C2Z) got in my trading account and were executed on Wednesday; I was totally shocked and I was also happy for a moment because they were making profits on Wednesday as the corn futures (C2Z) price fell that day. I soon got scared as I anticipated a price jump on corn futures on Thursday with the release of the USDA report. It’s based on the information and analysis from a few sources before Thursday:

- speculation about USDA would lower its forecasts on global supplies: dry weather damaged crops from Russia to Australia; Russia cut its forecast for grain export, Australia last month reduced its harvest projection [1]

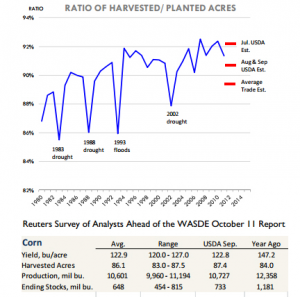

- on average, analysts expected the corn production would below the USDA September estimate due to the reduction in harvested acres[2].

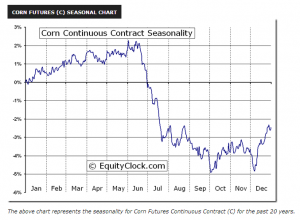

- Also, there’s a corn futures contracts continuous chart for the past 20 years indicating the rise in October.

Therefore, I placed an order to offset all those short contracts on Wednesday night. I did something similar once before where I placed an order at night and the order got processed the next day once the market opened with the open price. I basically trusted that TradeSim would treat my offset with as open order and gave them the open price. The prices did go up on Thursday by quite a lot. However, the offset didn’t happen in time as I expected and those 23 short corn contracts got offset at a much higher price. I lost $1463.50 per contract which lead to a total loss of $33660.5; together with the losing long wheat and soybeans contracts I have been holding since 2 weeks ago purchased at the peak prices, my equity was down to about $100 at the end of Thursday.

I did order to offset the long wheat and soybeans contracts on Thursday, yet with price limits which was not hit. On Friday, all the crop futures prices went back down and my long contracts once again suffered further loss which lead my balance down at about -$2000.

It’s a dramatic and traumatic week. Although the 23 contracts got in by mistake/ accident, I could have not lost that much by making a stop loss order to offset or just keep them till Friday. This is a big lesson to me.

Thanks VW for encouraging me to write this blog and helping me recover from the trauma.

References:

1. McFerron, Whitney and Dreibus, Tony C. (2012, Oct 09). Wheat Climbs as U.S. May Cut Supply Estimates; Soy, Corn Gain. Bloomberg. Retrieved from http://www.bloomberg.com/news/2012-10-09/wheat-climbs-on-speculation-u-s-to-cut-global-supply-estimates.html

2. Meyer, Steve and Steiner, Len. (2012, Oct 09). CME: Harvest Pressure Pushes Corn, Soy Futures Lower. The Crop Site. Retrieved From http://www.thecropsite.com/news/12158/cme-harvest-pressure-pushes-corn-soy-futures-lower

3. Equity Clock. (n.d.). CORN FUTURES (C) SEASONAL CHART. Retrieved from http://charts.equityclock.com/corn-futures-c-seasonal-chart

5 replies on “Week 4 – What Went Wrong: Accident”

Great summary on what happened last week, Roson! Let’s hope Jim resets the system for you soon, and you can go back to being a happy trader (like your blog title says) again! 😉

Yikes, that sounds like a fairly terrible experience. I am also starting to notice the huge delay when putting in trades in the night time and expecting the trade to go at the open price the next day. However, I end up getting the prices about an hour after the market opens. On days where the USDA food reports come out, that one hour after the report comes out can have huge price jumps and it is really scary. I guess you didn’t mean to be in the market with that many contracts, but that happening on the day before the food report must have been crippling. Hopefully you get on your feet soon.

Hey Vicky, Jim will try to do that tomorrow. =] Thanks!

Hi Andrew, I guess the delay is a pain to everyone. Not sure how it’s like in the real market.. whether there is delay, it should be small.. But with dramatic price changes, it does make a big different for every second of delay.. Good luck with you future trading too.

Hi Roson,

Sorry to hear what had happened. But great job on blogging. I like the structure. Easy to read and clear explanation! Good job! No worries about the loss. It’s just a part of learning process. Hope we fix the problem and you can get back to trading soon. Thanks.