Reading Baudrillard’s (2001/1999) “Impossible Exchange” in the midst of 2009’s international liquidity crisis, a reader experiences an unexpected form of déjà-vu in response to Baudrillard’s description of the hyperreal and, in particular, his description of the “Great Game of Exchange” (p. 7), a game grounded in an endless exchange of nothing; a game that leads in the end to the liquidation of everything and “passing around the debt, the unreal unnameable thing you cannot get rid of” (p. 7). The déjà-vu stems from having read of the international financial crisis in the contemporary press, where it and its causes are described in language that could easily have been written by Baudrillard’s simulacrum (were it not dead).

Consider a paragraph from a special issue on liquidity published by the Banque de France in 2008 written by two American economists:

The heart of the recent crisis is a rise in uncertainty – that is, a rise in unknown and immeasurable risk rather than the measurable risk that the financial sector specializes in managing. The financial instruments and derivative structures underpinning the recent growth in credit markets are complex. Indeed, perhaps the single largest change in the financial landscape over the last 5 years has been in complex credit products: collateralized debt obligations (CDOs), collateralized loan obligations (CLOs), and the like. Because of the rapid proliferation of these instruments, market participants cannot refer to a historical record to measure how these financial structures will behave during a time of stress. These two factors, complexity and lack of history, are the preconditions for rampant uncertainty.

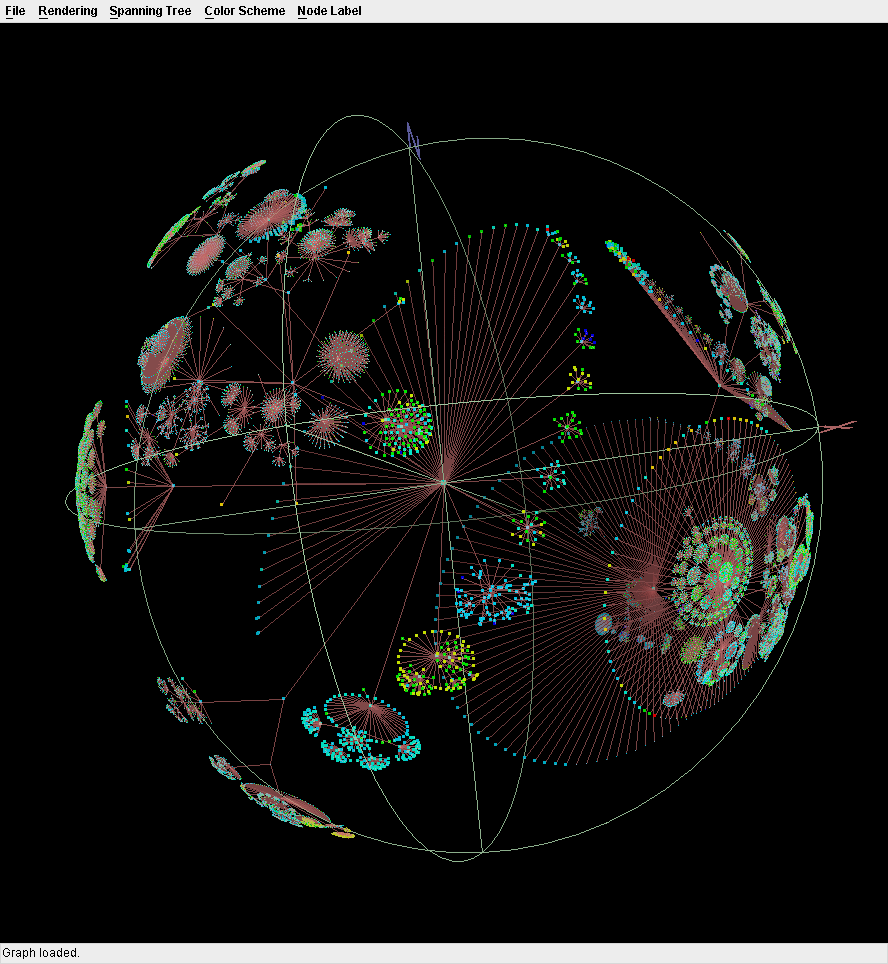

Driven in large part by the creation and hyperactive circulation of highly abstract (complex) credit instruments, financial markets are paralyzed by uncertainty, by the inability to forge meaningful relationships between a real estate and debt, between the real and a sign that stands in for the real (in order to be circulated within sphere of financial markets). They can no longer test or trust the value of signs; the value of signs no longer rings true in relation to the real assets they were intended to guarantee.

Baudrillard saw this coming. He would not depend upon the safety of his investments in retirement savings within this indeterminate market (if he had invested at all) knowing that: “When there is no longer any internal reference system within which exchange can take place (between production and social wealth, for example, or between news coverage and real events), you get into an exponential phase, a phase of speculative disorder” (p. 6). He would also find it ironic that the American banking system (recently nationalized without reference to that word) was now developing out a new complex means to wrap up toxic debt so as to allow, once more the free flow of credit. That such a move is necessary to allow for the impossible exchanges that need to take place to support the international finance system provides empirical proof for Baudrillard’s take on the system:

Behind the exchange of value and, in a sense, serving as an invisible counterpart to it, behind this mad speculation, which reaches a peak in the virtual economy, behind the exchange of Something, we have, then, always, the exchange of Nothing.

It is likely that Baudrillard would be quite entertained by the sight of so many financiers nervously peering into the chasm, the void that has opened beneath the market like a sinkhole for a sign of a bottom.

References

Baudrillard, J. (2001). Impossible Exchanges. (C. Turner, Trans.). London: Verso. (Original work published 1999)

Cabellero, R., Krishnamurthy, A. (2008) Musical Chairs: A Comment on the Credit Crisis. Banque de France, Financial Stability Review, 11, 9-11. Retrieved March 30, 2009 from http://www.banque-france.fr/banque_de_france/gb/publications/rsf/rsf_022008.htm