There is a need to explain why get in the game with credit card signup bonuses while 4 other main sources of miles include actual fly, hotel stays, purchase & promotion and purchased miles.

The proportion goes like this: (US travel hack)

(Source: http://onemileatatime.boardingarea.com/)

The main idea is credit card signup bonuses do not cost a lot — usually a couple hundred dollars , if not free at all. The dollar-mile ratio is ridiculous, it could be $1:200-400 miles easily. In contrast, the ratio in other ways to rack up miles is still good but not as ridiculously great.

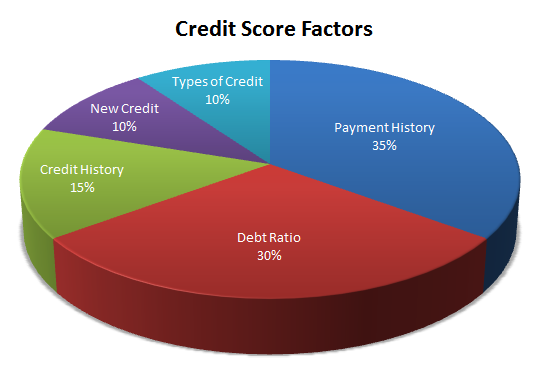

Of course, the cost of credit card signup bonuses does not end here. It is just that the major cost comes from your credit score. Every new credit request, no matter it is successful, affects your credit score. In contrary to the public perception, new credit request is not as scary because it only makes up 10% of your credit score. That means your dream travel plan could only cost you some annual fees and 10% of your credit score at the most. When you are pushing your credit card applications in a short time frame, take the rejections as a sign of limit — you have applied enough of it.

(Source: http://www.moneyproblems.ca/)

As you may figure, new credit requests have a much smaller impact on your credit score than payment history and debt ratio. In fact, the key is to perform well in these two segments.

Payment history is essentially whether you pay your loan back on time every month. This is critical from a credit or travel hack perspective. Having overdue payments will have larger impact on your credit score than many new credit requests, and the interest incurred will greatly diminish the value of the miles you earn. (Some credit card companies such as American Express will withdraw the earned miles of the month if you fail to pay on time.)

Debt ratio is your credit balance of all cards divided by your credit limit of all cards. The lower the debit ratio is, the better it does to your credit score. So having 10 cards under your name while using 3 of them regularly is better than having 3 cards and using all regularly given that each card has the same credit limit.

That being said, after a “recession” on your credit score as a result of many new credit requests, a “recovery” and even “new height” will occur in a few months when you use your cards strategically.

Bottom line

Get a credit report before you start travel hacking. Know your baseline. Check up on it regularly. Don’t overkill. If you are planning to get a car loan or mortgage in the near future, it may not be a good timing for you to start travel hacking.

Hi, I especially wanted to say I loved your blog and how well-curated it was. Credit cards can be a difficult topic to cover on the internet solely because of a lot of misleading information. I am very glad your article is down to earth and very informative. Kudos and keep up the good work.