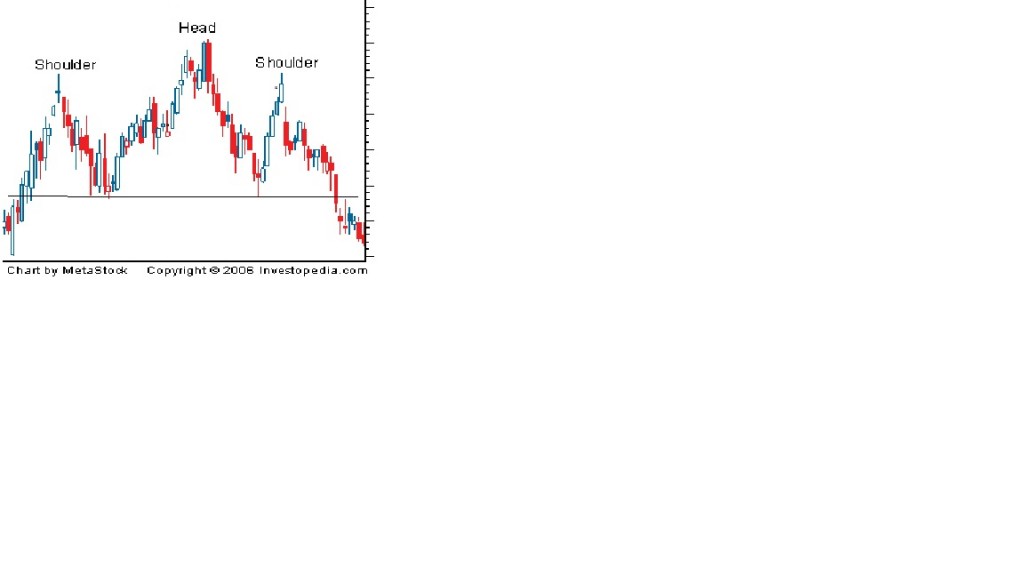

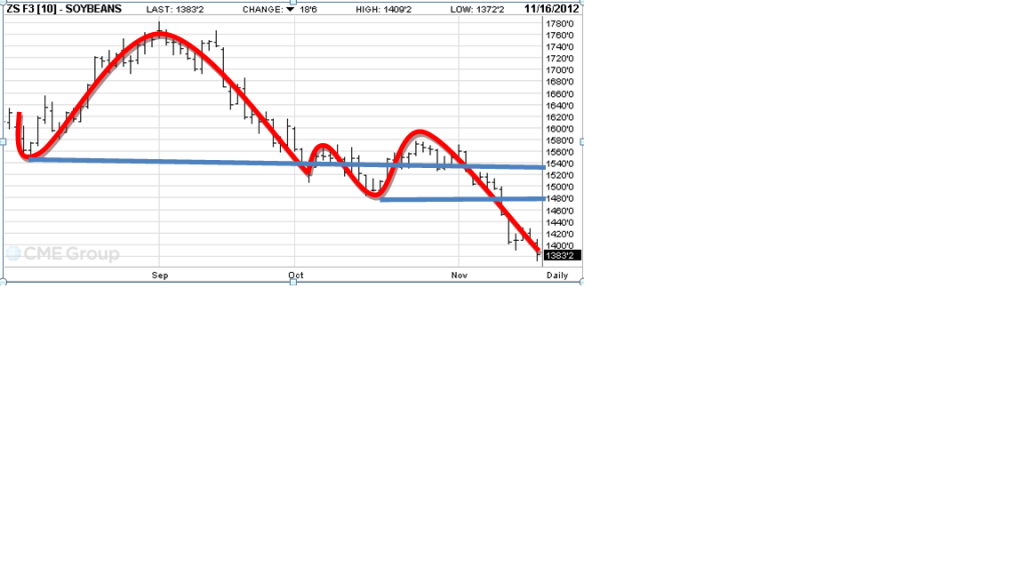

Based on a technical analysis, soybean future price has a Head and Shoulders Pattern. The future rises to a peak and subsequently declines. The second peak following after the first decline is above the former one and soybean future price declines again. It finally rises again, but not as much as the second peak, and declines. One huge and two side peaks looks like a head and shoulders. There should be a head when the price hits $1480, but it kept declining. This huge decline was due to China’s cancellation. China canceled about 600,000tonnes of US soybean. Favorable weather forecasts large soybean production in Brazil and Argentina, the world’s second and third largest soybean exporter. USDA crop report’s soybean estimation is also higher than expected. It is forecasted that the soybean market will keep being bearish following week. Corn market will be little bullish as the US government decided to maintain its mandate to add corn ethanol to motor fuel. However, fiscal cliff in US will possibly weaken agricultural demands and dampen any bullish signs on the grain markets. I will try to offset the positions I have, not getting any new contract.

http://www.investopedia.com/terms/h/head-shoulders.asp#axzz2CZxJFQ3l

http://www.manitobacooperator.ca/news/u-s-soy-sets-five-month-low-as-china-scraps-orders/1001863110/