Good day friends and followers:

I completed a fairly intensive research project for a local investment manager here in Seattle over the past couple of weeks and I have decided to publish my research. Please see the report below on Itron (ITRI).

Itron Investment Thesis

Overview

As the world moves toward enforcing a more energy efficient environment, innovative new products have emerged which give users and utility operators the capability to monitor resource usage more accurately and in real time. One of these innovations, appropriately titled the “Smart Meter” offers the opportunity to more effectively manage energy usage and also provides complete transparency as to how much of a particular resource is being used. Additionally, these smart meters can collect data and provide analytics which can help lead to a more sustainable world.

Governments around the world are rolling out mandates which establish the requirement for smart meters to monitor energy usage. Along with this, companies large and small are battling for these contracts. Based within the Pacific Northwest region, Itron is an international leader in providing metering solutions for electricity, gas, and water utility companies. Their goal is to continue to innovate their product and service mix to more efficiently “Analyze, Manage, & Measure” utility output and consumer usage.

Financial Analysis

Over the past 5 years Itron has underperformed its competitive set even though they have continued to grow their business. Competition in the industry has picked up as giant conglomerates such as General Electric enter the field. Furthermore, the sales cycle has slowed due to economic uncertainty and other delays. While Itron is still an international leader in the industry, their earnings have been extremely volatile and they have announced annual losses in 3 of the past 5 years. The company’s 2014 guidance points to another soft year, and will likely be their fourth consecutive year of decreasing sales.

Another area of concern is their buildup of intangible assets and the firm’s penchant for asset write-downs. Itron declared an asset impairment of over $500 million in 2011 and of $137 million in Q4 2013. While they still hold intangibles and goodwill of close to $750 million on balance sheet, their pace of amortization for these assets has slowed and future write-downs are limited although still a looming threat.

On a brighter note, Itron’s restructuring process continues to show glimmers of hope and there is an expectation that margins will bottom out in early 2014 if they have not already.

Valuation

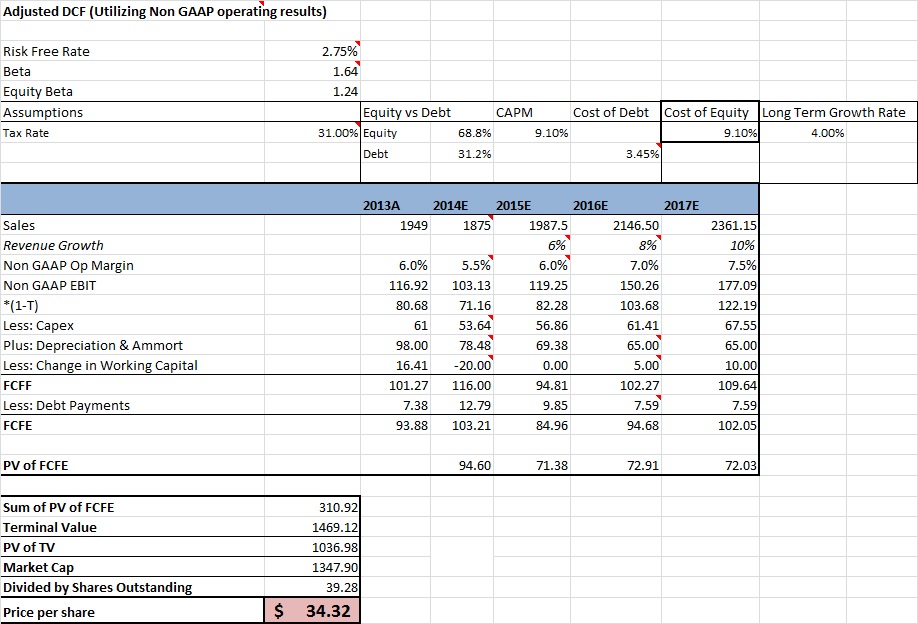

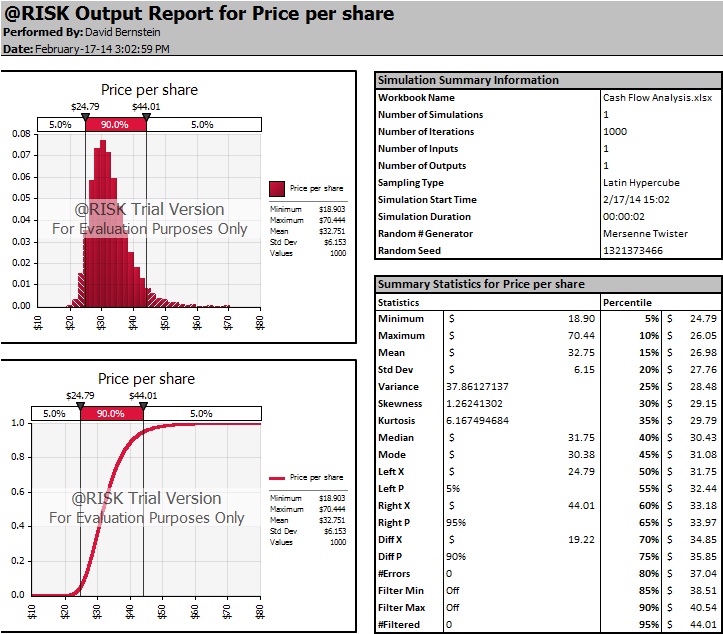

Using Itron’s published Non-GAAP operating income, historical financials, and forward guidance, I developed a discounted cash flow model which values Itron at $34.32 per share. The Non-GAAP operating income provides a more normalized picture of the firm’s cash flow potential and pure business value. Since the long term growth rate was the biggest assumption in the model, I completed monte carlo analysis with a normal distribution on this growth rate. The results show a positive skew, with much more upside then downside, and a 90% probability range of $24-$42.

In reviewing Itron’s multiples compared to their competition, I first calculated the Price to Tangible Book Value due to the firm’s substantial amount of intangible assets and goodwill. Using a 5x multiple which was the mean of the comp set, I arrived at an expected value of roughly $16 per share based on Itron’s current tangible asset balance. However, this must be taken with a grain of salt since this expected value essentially only generates a floor for Itron’s equity value.

The EV/EBITDA multiples show the other side of this story. Since the current EBITDA is negative, I used my projected adjusted EBITDA for 2014 and 2015. The FY1 and FY2 EV/EBITDA multiples for the comp set put the expected value of Itron shares close to $50. If Itron’s margins do in fact bottom out in 2014, and the firm begins to show some revenue growth, their shares could be valued more in line with the rest of the comp set.

While we are discussing upside, I may add that Itron also has the potential to continue to innovate and develop new products. Additionally, they are still looking to realize some synergies from their recent acquisition and their board continues to approve share repurchases which have helped to beef up earnings to some extent.

Investment Thesis

From this research, I expect Itron shares to continue to UNDERPERFORM both the market and the firms competitive set in the immediate term. While the company’s backlog of orders continues to grow, their slow restructuring process has decreased margins. Furthermore, sales and decision cycles are continuing to take longer than expected. There is also a chance that they will be plagued with another asset impairment charge at some point in the future. Due to the companies distress, I am placing an 8x EV/EBITDA multiple target to their 2014 adjusted EBITDA to get a price target which is in line with my discounted cash flow model. Near term price target: $32.00

In the longer term, I see potential for Itron to recover lost ground. They are an industry leader with strong international exposure in a field that is expected to see tremendous growth over the next 5 years. Once the firms restructuring is complete and signs emerge that sales growth has returned, Itron may be valued more in line with its competitive set. This could cause the stock to rise significantly. Considering this, Itron may offer excellent investment potential and could be a strong value if one is able to enter near the bottom of the business cycle which seems likely to occur sometime within the next year.

If you enjoyed this article please feel free to donate Bitcoin. I am also available to complete consulting projects and am willing take requests for research projects in return for bitcoin.

Follow

Follow