Parenthetical Definition

The capitalization rate (valuation measure) will have to be determined for that particular property.

Sentence Definition

A capitalization rate is a valuation metric that is used in commercial real estate to describe the rate of return on a particular real estate investment. It is usually stated in a percentage format and allows investors to quickly determine how much to pay for a potential property.

Expanded Definition

What is a capitalization rate?

A capitalization rate, often just known as “cap rate” is a valuation metric that is most commonly used in the commercial real estate industry to help determine the value of a particular property.

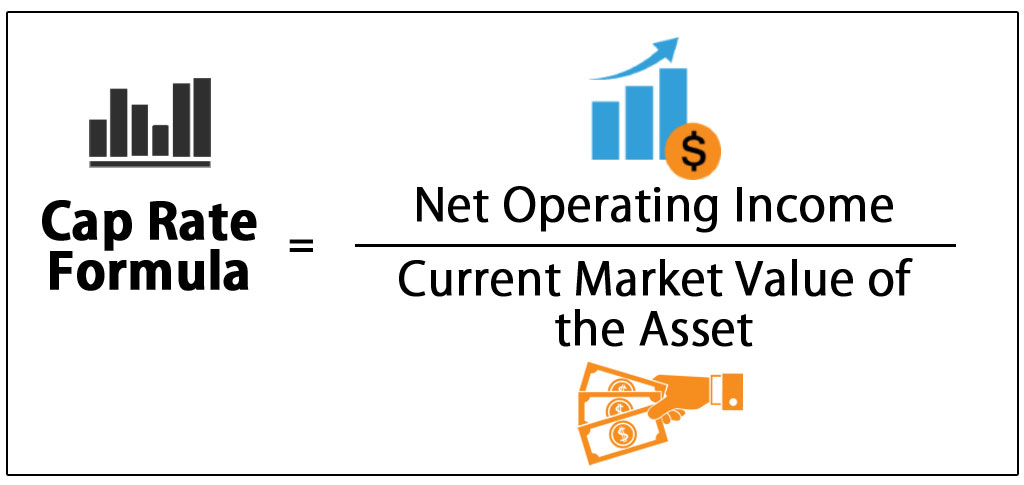

How is it calculated?

A cap rate is simply calculated as the ratio between a properties net operating income (rental income after expenses) to asset value or sale price, with the resulting ratio being expressed in a percentage format.

How is it used?

A cap rate can be used in several ways to help make value-based decisions. If you are looking to determine how much a commercial property is worth you simply divide the properties current net operating income (NOI) by the market cap rate.

Ex: $245,000 NOI / 3.5% Cap Rate = $7,000,000 Estimated Value

Using this quick calculation helps identify how much a potential property is worth

You can also use the above method in reverse in order to determine what cap rate a property is currently being valued at.

Ex: $245,000 NOI / $7,000,000 Estimated Value = 3.5 % Cap Rate

How does it help with making decisions?

A cap rate directly takes into consideration the single biggest factor of value for commercial real estate which is its potential ability to produce rental income. With this is mind, a cap rate can either help determine what a property is worth given the current yearly rental income, or it can help identify how much rental income a property should generate given its current estimated value. In essence, a cap rate helps provide a quick, uniform and professional method for all market participants to value potential assets and identify the return on their potential investment.

It’s important to note that cap rates are inversely related to price, basically the lower the cap rate the higher the estimated value of the property. Using this as a guide, an investor can quickly determine the attractiveness or the degree of risk of a potential investment. If a commercial property is considered attractive with low risk it will have a low cap rate and higher estimated value because investors have driven up price (cap rate goes lower) and are willing to accept less of a return on their investment. This also works in the opposite direction for less attractive markets or properties. Below is an example:

Ex 1: Kitsilano Apartment Building

$210,000 Net Operating Income / 2.8% Cap Rate = $7,500,000 Market Value of Building

Low Cap Rate = More Desirable Area which = Less Overall Risk to Investment

Ex 2: Detroit Apartment Building

$210,000 Net Operating Income / 16.0% Cap Rate = $1,312,500 Market Value of Building

High Cap Rate = Less Desirable which = More Overall Risk to Investment

Limitations of its Use?

Although capitalization rates are quick, accurate and useful in determining what a commercial property is worth, its important to note when they shouldn’t be used. Cap rates shouldn’t be used in the following situations:

- Single family or owner-occupied home

-

- Cap rates are most effectively used on properties that are purchased solely for rental income, usually single-family homes are valued more accurately based on what other comparable properties have sold for and not their rental income

- Extremely old properties with low rents and high land values

- Cap rates shouldn’t be used in these situations because the low rental income will result in a value that isn’t accurate with what the property is actually worth

- Commercial property that has inconsistent and irregular rental income or high vacancy

- Cap rates use rental income as the primary driver to determine estimated value, if these rents are uncertain or inconsistent it will result in a less accurate measure of value

- Newly constructed buildings

- Cap rates shouldn’t be used on properties that are newly built, only properties with stabilized rents (over at least 1 year) should be used

- Acquisition of property where precision and accuracy are important

- Cap rates provide a quick and easy to understand method of valuation for common investors, if a more extensive or accurate valuation method is needed a more rigorous method like a multi-year DCF analysis should be used

Works Cited

Investopedia. (2019). Capitalization Rate. [online] Available at: https://www.investopedia.com/terms/c/capitalizationrate.asp [Accessed 24 Sep. 2019].

Schmidt, R. (2019). What You Should Know About The Cap Rate. [online] Propertymetrics.com. Available at: https://propertymetrics.com/blog/cap-rate/ [Accessed 24 Sep. 2019].

People.stern.nyu.edu. (2019). [online] Available at: http://people.stern.nyu.edu/adamodar/New_Home_Page/articles/caprate.htm [Accessed 24 Sep. 2019].

EDUCBA. (2019). Capitalization Rate Formula | Calculator (Excel template). [online] Available at: https://www.educba.com/capitalization-rate-formula/ [Accessed 24 Sep. 2019].

Hello Ranjit,

I have finished the peer review for this assignment. follow the link below

https://blogs.ubc.ca/engl301-99a-2019wa/2019/09/26/peer-review-of-definitions-2/